Remember this familiar childhood tune? The rationale of joining the digital transformation circle works on the same principle…

With digital transformation in South-east Asia (SEA) being a business imperative, participating in digital ecosystems can create long-term value and competitive advantage.

This is what a report, said to be “based on EY insights and industry interviews, conducted between December 2020 and March 2021” asserts.

What is a digital ecosystem? It is defined by EY here as “an interconnected set of offerings that fulfils consumer needs in one integrated experience, comprising businesses across different sectors that collectively offer a broad range of products and services.”

The EY report asserts that collaborative consumption and the sharing economy have been on the rise in the region, driven by an internet penetration of around 63% and a growing tech-savvy middle-class population that is rapidly moving up the socio-economic ladder. This is paving the way for sharing models across different sectors such as mobility, travel and hospitality and real estate.

Navigating digital ecosystems

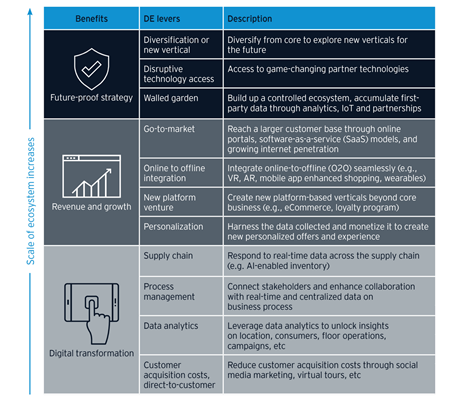

Organizations should consider three areas when navigating digital ecosystems, according to the report:

- Evaluate the organization’s digital ecosystem (DE) maturity: The three maturity levels are:

- DE adaptor, where the transformation is at a modular level and limited to a particular business unit or geographic market

- DE accelerator, where the organization scales the transformation to a company and industry level

- DE attacker, where the organization drives large-scale transformation across multiple industries through cross-sector collaborations and leverage technology capabilities across different parts of the value chain.

- Define the business model: The business model to undertake as a DE participant is based on different parameters such as:

- Nature of the ecosystem (e.g., open or closed)

- The scale of industry partnerships

- The revenue model

- Implement the ecosystem: Once a DE opportunity has been identified, they need to follow a step-wise process to design an ecosystem by identifying the following before defining the evolution roadmap:

- The most suitable role to undertake (a DE orchestrator, partner or enabler)

- The nature of the ecosystem, product market fit and monetization model;

- The key enablers of the DE.

DE orchestrators must also consider how they will mobilize the DE: whether through building, buying (M&A or investment) or partnering (joint venture, alliance or strategic contract).

According to the firm’s ASEAN Regional Managing Partner, Liew Nam Soon, consumer-focused digital ecosystems are forming across SEA to deliver value at unprecedented speed and scale, in response to industry digital disruptions and accelerated by the pandemic. There is rapid growth of start-ups and digital natives.

Some of the leading digital natives in SEA are transforming into super digital platforms, by delivering interconnected services through an integrated experience, from ride-hailing, food delivery, grocery, logistics, through health, lifestyle and financial services.

“Today’s consumers expect speed, responsiveness and access with a hyper-personalized experience. Digital ecosystems help companies create value through revenue growth, gain new market access, decrease customer acquisition costs, and ultimately strengthen and retain customer relationships,” said Liew.

As a result, the super apps are attracting the attention of investors, having witnessed investments worth US$43bn between 2016 and 2019, with the potential to generate revenue opportunities of US$23b by 2025, from about US$4b in 2019.

Digital interactions in both B2B and B2C

Recognizing the opportunities in the digital ecosystem, traditional market players are leveraging partnerships and strategic alliances to share resources, data and capabilities to create digital ecosystems to compete with digital natives.

Said Joongshik Wang, EY-Parthenon Asean Leader: “Being part of a digital ecosystem allows businesses to leverage the network effect to create a competitive advantage. However, to do so, companies must get their digital transformation strategy and capabilities right. The question is whether they should design or join a digital ecosystem, and choose to buy, build or partner.”

Established, traditional firms are often outpaced by the emerging digital natives that are ahead in digital adoption. Wang said most traditional firms have been focusing on their core business and may be hesitant to build a platform-based business due to legacy systems and corporate culture. “Thus, traditional firms are turning to collaborating with e-commerce and last-mile platforms to offer digitalized, streamlined and omnichannel experiences to their customers.”

Liew concluded that digital interactions in both B2B and B2C activities are expected to stay and gain ground even after the pandemic, and enterprises in SEA will be seeking to transform their business digitally to drive profitable growth as well as work with partners to provide solutions leveraging technology to address value gaps.