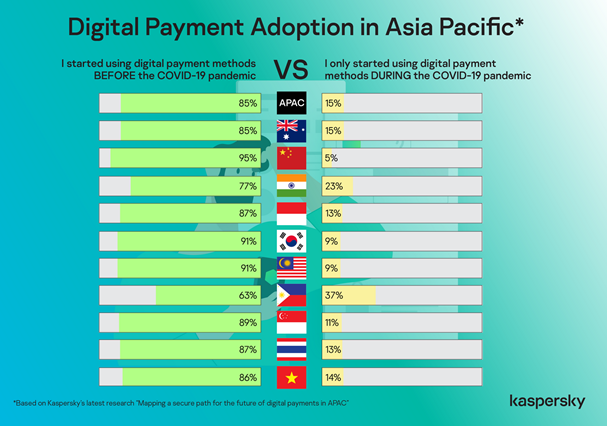

According to one APAC survey, new adopters averaged around 15%. The main push came from pandemic measures and e-commerce platforms.

In a July 2021 study involving 1,618 respondents aged 18 to 65 (working professionals who were digital payment users) across Australia, China, India, Indonesia, Malaysia, Philippines, Singapore, South Korea, Thailand and Vietnam, it was found that 15% started using digital payment platforms only after the pandemic started.

The Philippines logged the highest percentage of new e-cash adopters (37%), followed by India (23%), Australia (15%), Vietnam (14%), Indonesia (13%), and Thailand (13%). The lowest number of first-time online payment users were from China (5%), South Korea (9%), and Malaysia (9%).

Obviously, the digital payment platforms were enabling respondents to adhere to social distancing (45%) regulations and lockdowns (36%). For 29% of respondents, digital gateways were more secure now compared to the pre-COVID-19 era; the same percentage also appreciated the incentives and rewards offered by providers to entice usage.

Other findings

The study by Kaspersky indicated that only 23% of people still influenced friends and relatives to adopt e-payment systems. The remaining push was from local governments (18%).

When asked about their fears and doubts prior to using mobile banking and payment apps, first-time users in the survey indicated “losing money online” (48%) and “storing financial data online” (41%). Less than four in 10 also revealed they did not trust the security of these platforms.

Some 26% of respondents found digital payment technology too troublesome and requiring many passwords or questions (26%), while 25% indicated that their personal devices were not secure enough.

According to Chris Connell, Managing Director (Asia Pacific), Kaspersky: “It is a welcome finding that the public is aware of the risks that come with online transactions and because of this, developers and providers of mobile payment applications should now look into the cybersecurity gaps in each stage of the payment process, and implement security features or even a secure-by-design approach, to fully gain the trust of the future and existing digital payment adopters.”