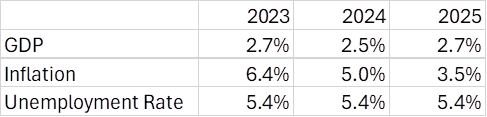

As countries head into the second half of 2024 amid elevated geopolitical uncertainty, KPMG economists are predicting that global growth is likely to slow, with a slight rebound expected next year.

Even as inflation is set to continue to cool, the price pressures faced by many countries will take longer to unwind than it took to emerge, according to the KPMG Global Economic Outlook Q2 2024 released recently.

The KPMG Global Economic Outlook is produced by leading economists from KPMG member firms around the world. This year’s report looks at the economic prospects for a selection of countries and regions in 2024 and 2025, including the potential for the world economy over the next two years.

KPMG Global Economic Outlook – Q2 2024

The latest predictions in KPMG’s Q2 2024 Global Economic Outlook reflect the current elevated geopolitical uncertainty, with nearly half of the world’s population already voting or heading to the polls in 2024. Armed conflict and trade tensions are flaring in numerous parts of the world which could fuel more isolationist policies. KPMG’s international team of economists believe the resulting risk could be more frequent bouts of inflation and the possibility of activist monetary policies.

A slower expected glide path on rate cuts by the US Federal Reserve, which plays an outsized role in global financial markets, will have a larger impact on rate decisions by developing economies. These markets are more sensitive to the exchange rate movements than we have seen in the past. Weakening currencies relative to the U.S. dollar are inflationary for those economies. To further complicate matters, foreign exchange markets have been reacting to unexpected election outcomes.

Between interest rate uncertainty and the elections, business leaders remain hesitant to engage in major investment projects. Consumers are cutting back on financed goods due to elevated rates, while governments face higher financing costs as debt rolls over at higher interest rates.

Friend-shoring, re-shoring and near-shoring are reshuffling supply chains as producers hedge against geopolitical risk, often at higher costs. The conflict in the Middle East has caused seaborne trade to be rerouted, while higher-than-expected demand and weather have also increased shipping costs. The National Atmospheric and Oceanic Administration expects a record number of major storms for 2024, which will only add to shipping times and snarled travel.

Protectionism, M&A and AI

Despite uncertainty deepening this year, KPMG’s economists remain cautiously optimistic about the long-term outlook.

Yael Selfin, Chief Economist at KPMG in the UK, said:“Prospects for 2025 are better, with inflation expected to return towards target and central banks more confident to cut policy rates from the current restrictive levels. The silver lining is a tailwind for big-ticket consumer purchases and business investment. Mergers-and-acquisitions activity could also gather steam, as financial conditions ease and dry powder is deployed. However, the uncertainty remains around the policy shifts, which will likely fuel more insular and protectionist policies.”

The much-vaunted productivity boost from generative artificial intelligence (GenAI) is unlikely to appear at the global level for several years. One of the largest hurdles is the energy needed to run the large language models. Those costs could exacerbate inequality between the developed and developing economies. While advances in AI could also disrupt the labor markets during the transition period, KPMG’s economic forecast is nonetheless consistent with a broadly stable unemployment rate globally.

Regina Mayor, Global Head of Clients & Markets at KPMG International, added:“For politicians and central banks, the challenge going forward is contending with the rise in political uncertainty, deglobalization and a changing workforce demographic, at a time when international collaboration and – simply – the availability of people to increase productivity, is at a premium.

“While challenges remain, the outlook – in my view – is cautiously optimistic. The inflationary pressures are easing in many parts of the world and the political will is gradually shifting toward consensus on the need to drive growth. There will be bumps in the road ahead, but we’re slowly seeing light at the end of the tunnel.”