As the urgency and novelty starts to wear off, e-retailers can take three steps to rekindle the frenzy in e-shoppers here.

Seasonal sales in South-east Asia (SEA) for Singles’ Day last year grew by 554%, but since then, sales growth has narrowed, according to data by Criteo S.A.

Analyzing data across 280 ecommerce players from nine markets in SEA, the firm has released its findings and forecasts on trending shopping ‘Double-Day’ (10.10; 11.11; 12.12, etc.) festivals for Indonesia, Singapore and Vietnam.

In Singapore, 11.11.20 was the most popular sales festival, with a 347% increase in retail sales, and a 253% increase in product views, in comparison to baseline figures in the same year. The next date, 12.12, recorded the second highest increase in sales, at 210%. Other notable increases in 2020 included a 137% increase in sales during 10.10, and a 124% increase in sales during the Black Friday period.

SEA’s Double-Day retail trends

According to Criteo’s data, while 11.11 had remained the largest shopping event in Singapore and Vietnam over the last few years, 12.12 emerged as the largest shopping festival for Indonesia last year.

Vietnam: 11.11 was the largest shopping moment, followed by 12.12 and 10.10. There was also a small spike during Black Friday sales

• 10.10: Online retail sales and traffic increases of 171% and 47%

• 11.11: Online retail sales and traffic increases of 378% and 126%

• Black Friday: Online retail sales and traffic increases of 78% and 48%

• 12.12: Online retail sales and traffic increases of 369% and 150%

Indonesia: 12.12 was the leading shopping festival, followed by 11.11 and 10.10. No sales spike observed during Black Friday sales:

• 10.10: Online retail sales and traffic increases of 46% and 18%

• 11.11: Online retail sales and traffic increases of 151% and 51%

• 12.12: Online retail sales and traffic increases of 196% and 63%

Southeast Asia (OVERALL)

• 10.10: Online retail sales and traffic increases of 95% and 36%

• 11.11: Online retail sales and traffic increases of 296% and 116%

• 12.12: Online retail sales and traffic increases of 305% and 127%

According to the firm’s Managing Director (SEA and India), Taranjeet Singh: “We are seeing that the growth in e-commerce sales (when compared with their respective baseline year) have been slowing down as more in the region get accustomed to remote work, life, and play. This is especially apparent for 11.11 sales in SEA. While retail sales continue to grow, we see that the rate of growth is narrowing. It is thus more important than ever for brands to understand consumer habits across online and offline platforms, and relook campaign strategies so that they can stand out from competitors and gain greater market share.“

Looking ahead to Singles’ Day 2021

While year-on-year sales growth is narrowing, retail spending is still increasing, so it is crucial for brands to improve their understanding of shopper behavior to stay competitive during such sales periods. Three points mentioned by Singh include:

1. Consumers are considering their gift purchases months ahead of the holiday season:

This behavior creates opportunities for consumers to make advanced holiday gift purchases, so e-retailers should make these planning moments count, and capture the attention of their shoppers in advance of year-end seasonal shopping moments.

According to Criteo data, around 51% of video and connected TV viewers in the region cited video streaming services to have influenced their purchasing decisions in the last 12 months.

Therefore, brands should consider advertising partners that can help them apply first-party data to build audiences.

2 . Festive experience will drive in-store shopping:

Insights from Criteo’s data of last year’s consumer behavior revealed that consumers in the analytics still preferred to shop for gifts in physical stores as they enjoyed the in-person shopping experience during the holiday season.

Others reported reasons like being able to see and touch items that they were considering, getting better shopping ideas in stores, and being able to make last-minute purchases if needed.

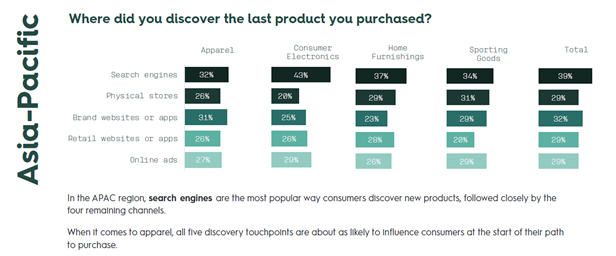

Search engines were found to be the most popular way consumers discovered new products across categories like apparel, consumer electronics, home furnishing and sporting goods last year. This was followed closely by physical stores, brand websites or apps, retail websites or apps, and online ads.

Brands need to have a strong omnichannel strategy to stand out, enable discovery and ultimately encourage engagement and purchase during the retail experience.

3. Convenience drives online shopping:

Respondents that preferred online shopping attributed their preference to the convenience factor, especially for younger consumers like Gen Z and Millennials. Others reported a higher propensity to buy gifts online as they believed they would find better prices.

Brands therefore need to relook their Commerce Media strategy, or to put one in place. This refers to a new approach to digital advertising that combines commerce data and intelligence to target consumers throughout their shopping journey and help marketers and media owners drive commerce outcomes.

After identifying their main shopper demographics, brands can then leverage awareness, consideration, and conversion campaigns during the festive shopping season to drive audiences from one stage of the customer journey to the next.

Regional retailers continue to look forward to the upcoming double day sales in 2021. One Vietnamese online retailer said that improving their understanding of e-commerce trend behaviors had allowed them to reach customers more effectively and engage them in more meaningful ways.