Developments in boosting cross-border transactions, embedded finance schemes and core banking modernization will shape SEA’s financial services industry’s fortunes: analysts.

According to EY analysts, the financial services sector in South-east Asia (SEA) will increasingly be characterized by instant cross-border payments, embedded finance and core banking modernization.

In the asset management sphere, the launch of the Variable Capital Company (VCC) 2.0 system will allow Single Family Offices to use the VCC as an evergreen investment vehicle. “VCC 2.0 and the continued growth in wealth and family offices will position Singapore as the wealth capital of Asia,” according to Mriganko Mukherjee, EY’s Asean Wealth & Asset Management Leader.

But while the innovation opportunities are profound, inter-operability and cross-sector convergence will introduce new financial crime and payments risks.

Key #1: Cross-border transactions

In some places, such transactions had been hampered by the high cost, slow speed, lack of transparency and security concerns associated with remittances. This year, more progress in collaborations in real-time payments, application programming interfaces (APIs) and blockchain control are set to take shape.

Adopting ISO 20022 messaging standards will help to overcome interoperability challenges, providing consistent messaging globally for data flows across the industry.

One key area on the agenda this year will be the increase in fraud being driven by real-time payments, which afford little time for authentication. In response, institutions will increasingly make use of integrated fraud services, where transactions can be screened and (if necessary) blocked in close-to-real-time.

Multiple risk mitigation strategies are also likely become commonplace, with biometrics and behavior authentication used alongside passwords and multi factor authentication.

Generative AI (GenAI) is expected to drive advances in identity fraud, with deep fakes increasing the likelihood of crime and rendering current Know Your Customer controls ineffective. In response, financial services CISOs will need to add the same technology to the cybersecurity armory. Investigation “copilots” will improve the consistency of decisions across volumes of data previously unmanageable for humans alone. Large language models (LLMs) will be used for transaction look-backs to significantly speed up transaction reviews by extracting relevant information, identifying transaction patterns and flagging suspicious activities.

Financial services firms will be training their own LLMs to increase responsiveness and agility.

Key #2: Embedded-finance developments

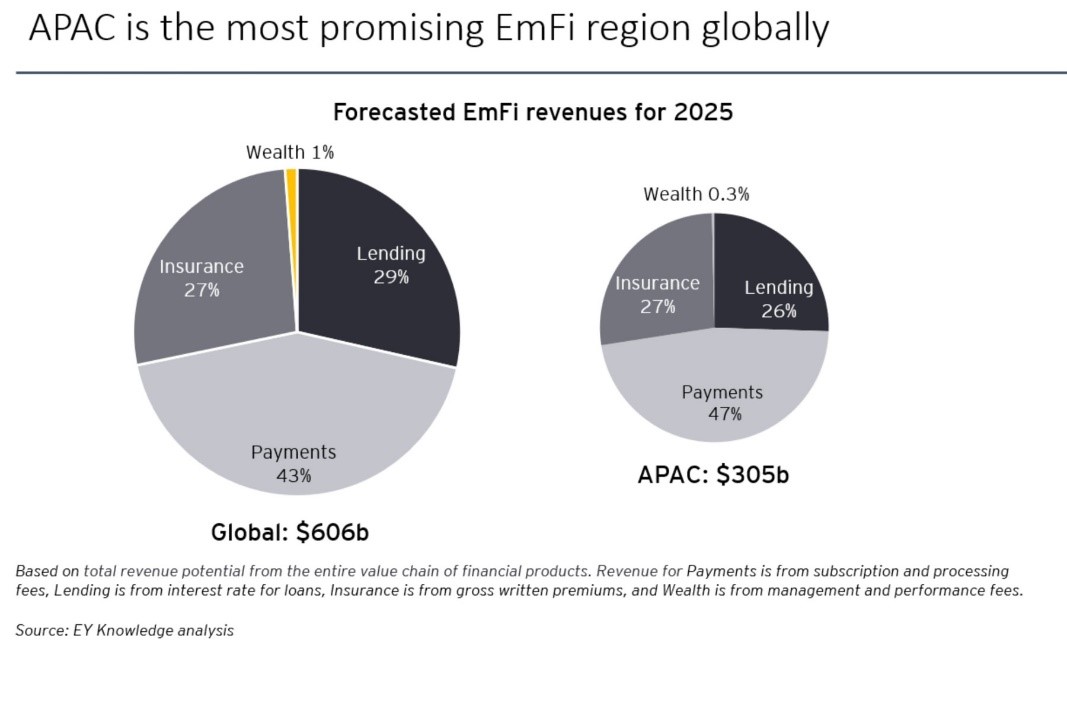

Non-financial-services firms will increasingly be embedding financial services in their core value propositions. This embedded finance (EmFi) is expected to drive cross-sector convergence as finance components are invisibly integrated into customers’ purchasing experiences.

EY analysts predict that ‘embedded wealth’ could soon be disrupting the dynamics of wealth management. Retail banks, for example, may offer “brokerage-as-a-service” as a value-add for customers with savings accounts. Equally, financial health platforms, which are already adding savings services, could similarly package investment services into their portfolios.

Payment firms will capitalize on embedded payments by developing integrated payment solutions leveraging data and AI, and providing value-added services. Insurance and lending will be the largest categories among the EmFi product spectrum, often bundled together, the analysts predicted.

Also, insurers are expected to integrate Insurance-as-a-Service into mobile apps and websites to attempt to become a core element alongside retailers and marketplaces.

This year, the most pervasive form of embedded lending is likely to be Buy Now, Pay Later (BNPL), with instalment products integrated into retail platforms. In SEA’s emerging markets, where a high percentage of customers struggle to secure traditional credit, BNPL providers can offer a financial lifeline. EY analysts therefore expect banks to use EmFi, in the form of BNPL, to promote financial inclusion.

Key #3: Core banking modernization

This year, the rise of open APIs is expected to create a connected network of financial institutions, software suppliers and fintech communities.

By further combining APIs with organizational structures such as low and no-code platforms, modular technology architecture and microservices, financial institutions will be able to innovate faster and more cost efficiently.

According to Seah Li Yun, EY’s Asean Banking & Capital Markets Leader: “Advanced technology such as GenAI, while in its early stages of adoption, will continue to be a growth accelerator as it optimizes processes and empowers the strategic delivery of customer focused solutions to drive new revenue growth.”

The year ahead

EY analysts believe that real-time payments, GenAI, embedded finance and core banking modernization are not merely trends but essential pillars for staying ahead in the industry.

By leveraging these technologies and concepts, financial institutions can enhance customer experiences, streamline operations and unlock new revenue streams, the analysts believe.