|

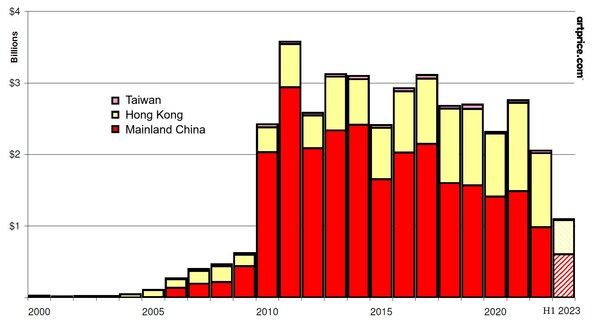

PARIS, July 12, 2023 /PRNewswire/ — Appearing rapidly at the head of the international art scene in 2010 with an annual art auction turnover total suddenly exceeding $3 billion, the Chinese marketplace has gradually structured itself around Beijing, Shanghai, and Guangzhou, but also increasingly around Hong Kong. Indeed, since the Covid-19 health crisis, Hong Kong has become the primary art market hub in the entire Asia-Pacific region. This year, however – and for the first time in ten years – Hong Kong is experiencing a slight contraction in its art market activity. Meanwhile, mainland China is slowly returning to a growth path.

thierry Ehrmann, President of Artmarket.com and Founder of Artprice: “We have had a privileged partnership with the Chinese group Artron for over a decade, and it is this long collaboration that allows our joint reports to identify and analyze the stabilization of China’s art market, with an effective reorganization of its market”.

Two works fetched over $30 million

At $33.1 million, on 24 February 2023 in Beijing, Yongle Auction hammered China’s best fine art result of H1 for an ink on paper by Cui Ruzhuo, Rafting In Wind And Rain (2019). It was also the best result in mainland China for over five years. But it was only the 18th best fine art auction result in mainland China’s auction history, a long way behind the $140 million hammered in 2017 for the 12 drawings that make up Qi Baishi’s Screens of Landscapes (1925).

In Hong Kong, on 5 April 2023, an ink on paper enhanced with gold by Zhang Daqian, Pink Lotuses on Gold Screen (1973), was acquired for $32.1 million at Sotheby’s. The island still fosters and promotes exchanges between East and West, recording multi-million dollar results for works by Yoshitomo Nara and Yayoi Kusama and works by Pablo Picasso and Jean-Michel Basquiat. At the start of the year, canvases by Miro, Magritte, Zao-Wou-ki, and Chagall naturally blended with sculptures by Jeff Koons and ultra-contemporary works by Matthew Wong, Nicolas Party, and Avery Singer in the finest Hong Kong catalogs.

In total, Artprice has detailed data for nearly 16,000 fine art lots sold at auctions throughout China between 1 January and 30 June 2023. Hong Kong retains the highest average fine art lot price in the world (just under $230,000) with 2,600 works generating $595 million (incl. buyer’s fees). But mainland China’s data is also honorable with over 10,000 lots fetching an average price of $78,000.

+180% growth in mainland China

While the art market is experiencing a sharp contraction in almost all Western countries, mainland China has posted relatively positive figures for H1 2023. Although it is still far from its exceptional performances of ten years ago, the country’s fine art auction market generated almost three times more turnover than in H1 2022, which was hampered by the country’s zero-covid policy at the time. However, the recent dynamism may have been boosted by sales that were simply rescheduled from last year; so it remains to be seen if the second half will post equally buoyant figures.

The performances of Chinese auction houses China Guardian, Poly, Yongle, Rombon, and Xilling have once again become all the more important since Western auction operators are no longer hosting sales in mainland China for the time being. Their sales have been entirely focused on Hong Kong, consolidating a turnover that has been growing steadily over the last two decades.

There is little doubt that the international art market is eager to see key works by the superstars of contemporary Chinese art resurface on the market. In H1 we saw several 7-digit results for works by Chen Yifei, Liu Ye, and Zhou Chunya, among others, and Bonhams sold Zeng Fanzhi Mask 2000 No. 3 (2000) for $3.1 million in Hong Kong. This result is consistent with those recorded ten years ago for the same series, but the works of these great names of ‘new Chinese painting’ have been circulating with much less intensity, and their masterpieces have been surprisingly discreet in auction rooms over the past three years.

Images: [https://imgpublic.artprice.com/img/wp/sites/11/2023/07/image1-china-s-fine-art-auction-turnover.png]

[https://imgpublic.artprice.com/img/wp/sites/11/2023/07/image2-Zhang-Xiaogang-Wan-Jie-thierry-Ehrmann.jpg]

Copyright 1987-2023 thierry Ehrmann www.artprice.com – www.artmarket.com

- Don’t hesitate to contact our Econometrics Department for your requirements regarding statistics and personalized studies: econometrics@artprice.com

- Try our services (free demo): https://www.artprice.com/demo

- Subscribe to our services: https://www.artprice.com/subscription

About Artmarket:

Artmarket.com is listed on Eurolist by Euronext Paris, SRD long only and Euroclear: 7478 – Bloomberg: PRC – Reuters: ARTF.

Discover Artmarket and its Artprice department on video: www.artprice.com/video

Artmarket and its Artprice department was founded in 1997 by its CEO, thierry Ehrmann. Artmarket and its Artprice department is controlled by Groupe Serveur, created in 1987.

See certified biography in Who’s who ©:

https://imgpublic.artprice.com/img/wp/sites/11/2023/04/2023_2_Biographie-thierry-Ehrmann_WhosWhoInFrance.pdf

Artmarket is a global player in the Art Market with, among other structures, its Artprice department, world leader in the accumulation, management and exploitation of historical and current art market information in databanks containing over 30 million indices and auction results, covering more than 817,000 artists.

Artprice by Artmarket, the world leader in information on the art market, has set itself the ambition through its Global Standardized Marketplace to be the world’s leading Fine Art NFT platform.

Artprice Images® allows unlimited access to the largest Art Market image bank in the world: no less than 180 million digital images of photographs or engraved reproductions of artworks from 1700 to the present day, commented by our art historians.

Artmarket with its Artprice department accumulates data on a permanent basis from 7200 Auction Houses and produces key Art Market information for the main press and media agencies (7,200 publications). Its 7.2 million (‘members log in’+social media) users have access to ads posted by other members, a network that today represents the leading Global Standardized Marketplace® to buy and sell artworks at a fixed or bid price (auctions regulated by paragraphs 2 and 3 of Article L 321.3 of France’s Commercial Code).

Artmarket, with its Artprice department, has twice been awarded the State label “Innovative Company” by the Public Investment Bank (BPI), which has supported the company in its project to consolidate its position as a global player in the art market.

Artprice by Artmarket’s Global Art Market Report, “The Art Market in 2022“, published in March 2023:

https://www.artprice.com/artprice-reports/the-art-market-in-2022

Artprice releases its 2022 Ultra-Contemporary Art Market Report:

https://www.artprice.com/artprice-reports/the-contemporary-art-market-report-2022

The Artprice 2022 half-year report: the art market returns to strong growth in the West:

https://www.artprice.com/artprice-reports/global-art-market-in-h1-2022-by-artprice-com

Index of press releases posted by Artmarket with its Artprice department:

https://serveur.serveur.com/artmarket/press-release/en/

Follow all the Art Market news in real time with Artmarket and its Artprice department on Facebook and Twitter:

www.facebook.com/artpricedotcom/ (over 6.3 million followers)

Discover the alchemy and universe of Artmarket and its artprice department https://www.artprice.com/video headquartered at the famous Organe Contemporary Art Museum “The Abode of Chaos” (dixit The New York Times): https://issuu.com/demeureduchaos/docs/demeureduchaos-abodeofchaos-opus-ix-1999-2013

- L’Obs – The Museum of the Future: https://youtu.be/29LXBPJrs-o

- www.facebook.com/la.demeure.du.chaos.theabodeofchaos999 (over 4 million followers)

- https://vimeo.com/124643720

Contact Artmarket.com and its Artprice department – Contact: Thierry Ehrmann, ir@artmarket.com

Artist Zhang Xiaogang in his studio, with Wan Jie, CEO of the Artron Group (left), and thierry Ehrmann, President of Artmarket.com and Founder of Artprice (right)