Another 176 more are already in the pipeline. A health sign of cloudification and digitalization?

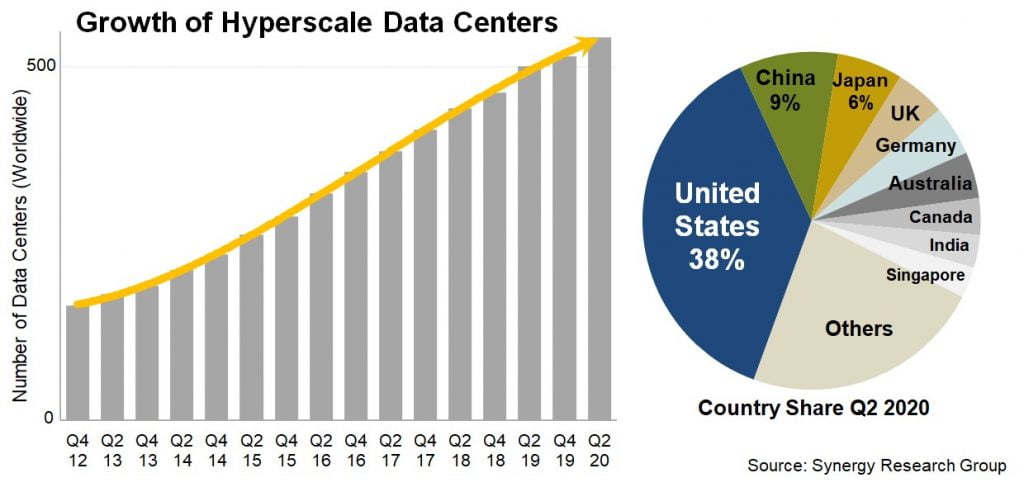

The total number of large data centers operated by hyperscale providers has doubled since mid-2015, increasing to 541 at the end of the second quarter of 2020.

The Europe, Middle East and Africa and Asia-Pacific regions continue to have the highest growth rates, though the US still accounts for almost 40% of the major cloud and internet data center sites.

The next most popular locations are China, Japan, the UK, Germany and Australia, which collectively account for another 30% of the total.

Over the last four quarters, new data centers have been launched in 15 different countries, with the US, South Korea, Switzerland, Italy, South Africa and Bahrain having the largest number of additions.

Among the hyperscale operators, Amazon and Google opened the newest data centers in the last 12 months, accounting for over half of the total, with Microsoft and Oracle being the next most active companies. Statistics from Synergy Research Group indicate that over 70% of all hyperscale data centers are located in facilities that are leased from data center operators or are owned by partners of the hyperscale operators.

What does this all mean?

The study involved analyses of the data center footprint of 20 of the world’s major cloud and internet service firms—including the largest operators in SaaS, IaaS, PaaS, search, social networking, e-commerce and gaming. The companies with the broadest data center footprint are the leading cloud providers: Amazon, Microsoft, Google and IBM. Each has 60 or more data center locations with at least three in each of the four regions: North America, APAC, EMEA and Latin America.

Oracle also has a notably-broad data center presence. The remaining firms tend to have their data centers focused primarily in either the US (Apple, Facebook, Twitter, eBay) or China (Alibaba, Baidu, Tencent).

Said John Dinsdale, a chief analyst at Synergy Research Group: “There were 100 new hyperscale data centers opened in the last eight quarters, with 26 of those being the first half of this year. COVID-19 has caused some logistical issues but these are robust numbers, demonstrating the underlying strength of the services that are driving these investments. We have visibility of a further 176 data centers that are at various stages of planning or building, which is good news for data center hardware vendors and wholesale data center operators.”