The Q1 reporting period in China reflected the immediate devastation of mobile commerce before lockdowns turned the tides.

The Q1 2020 figures for China’s third-party mobile payment market, published by independent market research firm, iResearch have revealed some expected trends.

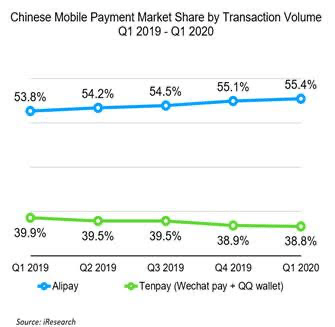

With a dominant share of 55.4%, Alipay remains in the lead as China’s largest third-party mobile payment company, followed by Tenpay (which is Tencent’s WeChat Pay + QQ Wallet) with 38.8%.

Alipay has continued to increase its mobile payment market share for four consecutive quarters since Q1 2019.

Amid the COVID-19 outbreak during the reporting period, China saw a decrease in third-party mobile payment transactions for the first time, at RMB53.2 trillion—a 4% drop compared to the same period in 2019.

With the release of the Q1 report, iResearch pointed out that future growth opportunities in China lie with the third-party payment providers’ capability to offer business clients integrated “payment + technology” solutions, instead of competing just on payment volume.

Payment is not the end game

Earlier in March, Alipay had announced a three-year plan to support the digital transformation of 40 million service providers in China. It committed to provide a platform for comprehensive digital daily life services, and a go-to app for consumers to find service providers to help meet their daily needs.

When asked about its view on the mobile payment market share, Alipay’s spokesperson emphasized that “payment is not the end game, but the beginning of a wide range of services that enrich daily life. We are dedicated to supporting the digital transformation of the services industry by leveraging our technologies, instead of just focusing on payment market share.”

This official sentiment reflects the company’s business model that aims not only to provide payment solutions but also, to provide a comprehensive digital suite of technologies, including payment, to service providers.