A study now shows that ‘social-scoring’ systems used to ‘protect citizens’ in a pandemic may lead to security and privacy-rights issues.

Amidst the COVID-19 pandemic, the world saw the implementation of automated systems to control people’s movements, their ability to buy goods, and their access to social services.

But are people actually ready for this? For safety reasons, users may need to share some private data and let the government monitor their social media activities. But, for many consumers, it still remains unclear how these automated systems of data-driven services work.

According to Kaspersky’s latest study to understand people’s perceptions of social ratings and their preparedness to be part of such a system, nearly half (46%) of consumers surveyed haven’t even heard of a ‘social credit system’.

What is it about?

The growing popularity of social media networks and online services has led to a growth in ‘social scoring systems’: automated algorithms that gauged users’ behavior and influence on the internet.

Initially, such ‘consumer assessment’ algorithms were integrated by financial institutions and e-commerce providers. Today, such systems are applied in many other spheres and sectors. For example, governments and organizations can assess which people are eligible for a wide range of real-world services. Moreover, with the COVID-19 pandemic raging, the world saw how such automated systems can be implemented to control people’s movements, their ability to buy goods, and their access to social services. But are people actually ready for this?

According to Kaspersky’s report titled ‘Social credits and security: embracing the world of ratings’, despite these social scoring systems being put in place and becoming more well-known, there is some ambiguity over how they operate and how effectively they are being implemented.’

The survey was conducted in 21 countries covering 10,500 consumers aged 17 and above, and 45% of consumers had experienced issues in understanding how a social credit system works. People can find it is impossible to discover their score, how they are being calculated and how the score can be corrected if there are inaccuracies.

Furthermore, as these social scoring systems are based on automated machine-learning algorithms, it is difficult to know what choices were made and whether it is possible to rely on the scores—especially in terms of security.

According to Kaspersky’s overview of the security of social scoring systems, such schemes can be particularly vulnerable to artificial manipulation. A hacker may be able to lower someone’s score for various ends. Additionally, like any other computer system, the scores are susceptible to different types of attacks, either on the technical and programming implementation or system mechanics. The latter could lead to the emergence of a new type of black market where users’ scores can be converted into real money and vice versa.

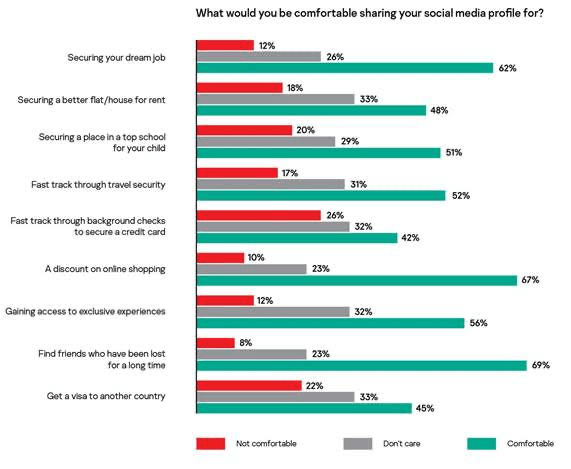

However, this does not prevent organizations from further collecting data, especially when people are willing to let it happen. Kaspersky’s report reveals that over 40% of respondents would share sensitive private data to secure better rates and discounts, and to receive special services. Moreover, consumers surveyed were much more prepared to share their social media profiles for other aspects of their daily lives.

![]() What did the survey show?

What did the survey show?

Remarkably, security issues were especially important for consumers. One-in-two survey respondents (51%) said they were happy for the government to monitor social media activity to keep its citizens safe.

Commented Marco Preuss, Director of Kaspersky’s Global Research and Analysis Team in Europe: “Governments and organizations are (digitalizing) quickly, helping them to benefit from technology and consumer data in new ways. On the one hand, technology and data improves their services for people in order to make our lives easier. On the other, it’s not clear how much access to personal information and people’s lives they can request, and most significantly, how they will handle it. This is especially important during situations of global self-isolation, when people have no other option but to rely on online services. And by needing to take control of public life today, people may lose control over their own lives tomorrow.”

Here are some findings of the study:

- The most common “traditional” social media platforms being used by consumers were Facebook (66%), YouTube (54%), Instagram (45%) and Twitter (40%).

- Nearly half (46%) of consumers had heard of a social credit system, while 45% of consumers had experienced issues in understanding how a social credit system works.

- More than two-fifths (43%) of survey respondents would share sensitive private data to secure better rates and discounts.

- Around half (49%) of survey respondents had tried to secure financing for education, vehicles or housing based on previous financial behavior.

- 51% said they were happy for the government to monitor social media activity to keep its citizens safe.

- 21% had experienced social credit system rankings. Some 42% had experienced a social credit system in public services.

- Every second (52%) consumer would share a social media profile so that they could fast track through travel security.

- Just 18% of consumers said they had experienced issues getting a loan or mortgage due to information collected about them from a social media account.

- A quarter (24%) of consumers said they do not trust the government with their data.

Genia Kostka, Professor of Chinese Politics at the Freie Universität Berlin said: “In the past, regulators and policymakers in most countries were not keeping up with the speed at which social rating systems were being widely adopted. Today, while they are being increasingly woven into the fabric of everyday life, it is important to discuss the risks that go along with them, such as privacy violations, discrimination and biases. Societies need to honestly and transparently discuss if and how they want to use such technologies, and, more importantly by whom and for what purposes.”

How should we keep score-safe?

While the current digital landscape may make it seem like sharing personal information online is inevitable, protecting privacy, both online and offline, is still possible. The team at Kaspersky recommends consumers to take the following steps to safeguard themselves against potential privacy loss and undesired social-scoring mishaps:

- Be conscious of what personal information you share online. While social media sites are designed to encourage us to share with others, any information you post is at risk of falling into the wrong hands. Do not forget to delete your account and history wherever possible when you stop using an app or online service. Check which connected services have access to your personal accounts.

- Be way that every part of our lives could be measured and scored. Use caution when sharing your personal information so that you are not denied a service for previous behavior.

- Sharing behavior has its benefits but only with the right services. An online survey may give you a discount off your favorite brand, but this may lead to a company learning more than you ever wanted them to know. Remain vigilant about your online activities.