A data-driven localized approach to prioritizing a seamless and transparent cross-border payment process to deliver trusted quality customer experiences.

As Asia Pacific (APAC) enters a golden age of digital trade, the region is simultaneously witnessing a remarkable growth in the e-commerce market. In fact, e-commerce sales in the region are expected to outperform overall retail sales from 2024 to 2028.

In 2024, the e-commerce market in APAC is also projected to reach approximately US$4.2 trillion, with expectations to continue growing to US$6.76 trillion by 2029, driven by a compound annual growth rate of 10%.

It’s no surprise then that consumer behavior has also drastically shifted. Now, more than ever, consumers are flooded with online marketplaces like Shopee and SHEIN, which have opened up global customer bases for merchants, removing logistical barriers to international expansion. At the same time, platforms like Shopify, WooCommerce, and Magento are empowering merchants of all sizes to easily create and manage online stores.

Social media has also played a part in breaking down borders by exposing consumers to emerging local and overseas brands through influencers, content creators, and advertising.

With 69% of consumers across Singapore, China, and Hong Kong expected to increase their amount of international online shopping, cross-border e-commerce is clearly a key frontier for business growth – but what exactly can businesses do to seize this opportunity?

The changing consumer landscape

In today’s climate, businesses rely on consumer attention and trust is a key component in the war for attention. According to Airwallex’s recent cross-border e-commerce report, trust in personal data security and willingness to trust international merchants has helped drive increased cross-border spend.

Businesses need to stand out in a saturated market by understanding their audiences deeply. Capturing and keeping attention requires cognizance of evolving consumer spending habits, which vary by region and country.

Shoppers in China, for instance, are motivated by the choice and quality of products from overseas merchants. Meanwhile, in Singapore, product quality, price, and variety are key drivers. Generally, there’s a strong appetite for international online shopping across all categories. However, global consumers shop from various channels, with regional preferences. Singaporeans are channel-agnostic, while Australians rarely use social media for purchases.

Nonetheless, the continued growth of social media platforms has undoubtedly reshaped the retail landscape. In Singapore, 25% of consumers use TikTok for international shopping, followed by Instagram (23%) and Facebook (22%). Across all markets access to deals and special offers, as well as speed and ease of purchasing, are key motivations for shopping cross-border via social media.

In today’s digital-first world, businesses need a multi-faceted strategy to succeed in e-commerce. This strategy should consider the age, location, and interests of the target audience. Focusing on creating seamless and engaging online experiences, leveraging influencers and content creators, and utilizing data to understand regional preferences are essential. Embracing these approaches will help businesses tap into the growing cross-border e-commerce market effectively.

Keeping up with payment preferences in the digital age

One key reason today’s consumer feels comfortable buying goods and services from anywhere in the world is the rise of digital payment methods. But as technology has improved, consumer expectations have also risen. When it comes to shopping online, customers expect to be able to pay via the payment method of their choice; it’s crucial that businesses understand the nuances of regional payment preferences.

While credit and debit cards remain popular, local payment methods like WeChat Pay and PayNow are gaining traction in Asian markets. 24% of consumers in China, 14% in Hong Kong, and 5% in Singapore prefer these local methods. Hidden costs, such as currency conversion and international fees, also impact loyalty, with 35% of consumers unlikely to return after being charged hidden fees.

Businesses expanding overseas can gain an advantage by using multi-currency payments technology to eliminate conversion fees and pass savings to customers. For example, Dreamcore, a Singaporean custom PC company, initially struggled with converting funds into foreign currency through their bank.

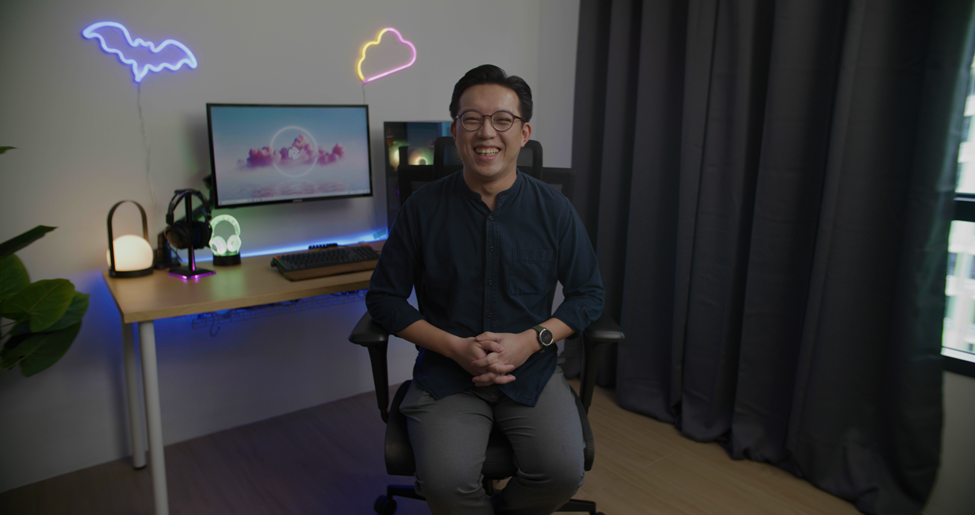

By leveraging Airwallex, Dreamcore was able to reduce transaction costs by converting SGD funds into USD or MYR at preferred rates and used digital workflows to save time sending payments to overseas suppliers. This integrated approval process allowed their finance team to review and approve payments in minutes, freeing up time for core business activities. “In my opinion, having a poor view of finances creates problems for growing businesses. To grow despite inflation and rising costs, we need a transparent view of our financial transactions,” said Eugene Lim, Co-Founder of Dreamcore.

Today’s digitally-savvy customers expect seamless integration of digital products into their lives. If technology forces them to adapt, they’ll leave. Therefore, businesses should prioritize creating a seamless and transparent payment process by truly listening to customers and delivering quality experiences. As the adage goes, “customer is king.”

Thriving in the golden age of cross-border e-commerce

With the e-commerce gross merchandise value in Southeast Asia expected to hit US$280 billion by 2027, it presents a significant opportunity for ambitious local businesses looking to achieve success in international expansion.

Ultimately, however, the winners will be businesses that invest in building cross-border customer experiences that are as seamless as their domestic ones. Marketing strategy, payments technology, and logistics infrastructure must all play a part in facilitating streamlined, localized customer experiences at a global scale. Only by taking a localized, data-driven approach to the user experience can businesses strike the right note with global customers, building trust and ultimately growing their cross-border profits. The rise of digital payment methods has made consumers comfortable buying goods and services globally. As payments technology improves, consumer expectations rise. Customers now expect to pay via their preferred method, making it crucial for businesses to understand regional payment preferences.