Online applications for insurance coverage will be streamlined and integrated into the national platform’s range of other benefits.

A pioneering digital life insurer in Hong Kong has announced the adoption of the country’s ‘iAM Smart’ identity authentication system.

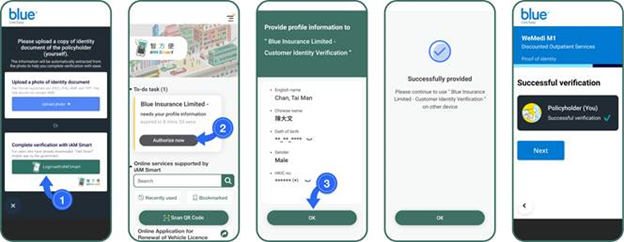

The latter stands for “internal access by mobiles in a smart way”, and involves the use of a mobile app to provide a one-stop personalized digital services platform. Users can log in and use online services via their personal mobile smartphones for not just identity authentication, but also for the automated filling of compatible e-forms; for signing up for personalized notifications, and on the iAM Smart+ version of the app—a digital signing function as well.

By adopting the platform, the digital insurance firm Blue expects to take complexity out of the personal insurance experience by providing a digital alternative for customers to verify their identity in a smarter and more convenient way during the online policy application process.

Beyond onboarding

With the iAM Smart platform, the firm’s customer will have the option to bypass the hassle of uploading an image of their Hong Kong identity card when they make new online policy applications. Instead, they can verify their identity in just a click within the ‘iAM Smart mobile app, if they are registered users, resulting in a better seamless digital customer journey with enhanced convenience and flexibility.

The firm’s CEO and Executive Director, Charles Hung, said: “This is fully in line with our mission to lead the complete digitization of the insurance experience, something that our customers are increasingly looking for. With the enhanced digital insurance journey, we hope to make lives easier and provide a higher level of peace of mind for customers.”

The platform is now available for its outpatient insurance coverage product, as well as its insurance scheme for coverage of pharmacy benefits—claimed to the first plan of its kind. In future, the national identity authentication system will also be adopted for the firm’s other insurance products.