A quarter of the businesses there were hesitant, perhaps due to lack of tech knowledge in senior management: study

Over 75% of Malaysian businesses have embraced at least one fintech product or service over the past 12 months. Mobile payments and digital wallets were the most widely-adopted, with 63% of businesses surveyed indicating usage. This trend is likely to continue in the next 12 months.

These findings are from a new regional survey of business fintech usage by accounting body CPA Australia.

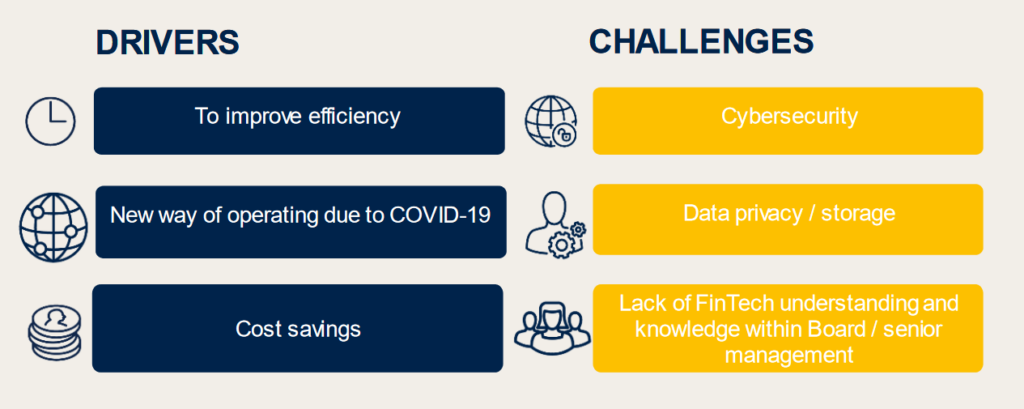

Overall, the survey analysis found that adoption of Fintech Companies in Malaysia has been driven by the need to increase business efficiency, with more than five in 10 respondents (56.3%) indicating so. Four-in-10 (40.4%) businesses adopted fintech as a means to adapt to the challenges posed by the COVID-19 pandemic. Just over a third (34.4%) saw the use of FinTech as a way of reducing costs.

Said Bryan Chung, Chairman of the Digital Transformation Committee at CPA Australia (Malaysia Division): “The increased popularity of mobile payments and digital wallets goes hand in glove with the government’s efforts to increase the use of e-wallets amongst the bottom 40% of income earners and the middle 40% through cash transfer programs, as part of its transition to a high value-added, high income economy.”

One possible area of concern is that one in four businesses surveyed did not expect to use fintech in the next 12 months, with the majority of these being businesses being those employing 50 or fewer employees. “Small businesses may not have a sound understanding of the benefits of fintech to their organizations. More needs to be done to improve small business understanding of what digital solutions might be good for their businesses,” said Chung.

What respondents were concerned about

Survey respondents were most concerned about cybersecurity and data privacy. According to the survey, fintechs will need to address these concerns if they are to see greater adoption of their products or services. “Greater consideration also needs to be given to increasing technology expertise at the board and senior management level to ensure better understanding of risks and benefits of fintech. Including fintech in the terms of reference of a board-level committee should help the highest levels of companies in Malaysia to stay informed of new trends in this type of technology,” Chung added.

Notably, there was an increase of 13.9% in the number of businesses in Malaysia using fintech lending, compared to Singapore’s 8.2%. As at December 2019, the Securities Commission reported that RM633m worth of peer-to-peer lending had been raised through 8,102 successful campaigns. Chung commented that start-ups, like other businesses, have been hard hit by COVID-19: “As such, alternative financing platforms are critical to their survival and growth as their limited track records would likely render them ineligible to meet bank lending criteria.”

The survey also revealed that while Islamic Fintech appears to be in its infancy, there is potential for growth both locally and regionally, with the country’s central bank’s support. “With the right skills, support and infrastructure, Malaysia is positioned to take Islamic FinTech to mainstream acceptance among ASEAN markets and beyond,” said Chung, who advised businesses to deepen their own fintech talent pool by retraining existing staff and by using innovative technology tools to secure new talent.