According to a research report on digital banking trends, banks either achieve unprecedented levels of adaptivity, creativity, and resilience—or perish.

How are digital technologies changing the banking industry’s customers, competitors, and business and tech priorities globally?

Over the past two years, the COVID-19 pandemic has redefined how people engage with their banks and how the latter have accelerated digital transformation to reduce customer anxieties over pandemic restrictions and other developing social and economic issues.

In its latest State of Digital Banking report, research firm Forrester has taken stock of the impact of digitalization on the industry.

Key findings include:

- Mobile banking has surged and now it dominates in Asia. People are increasingly using mobile banking to manage their finances and apply for financial products. According to Forrester’s data, mobile banking apps were the most popular banking channel in Asia, with 83% of Metro Indian and 78% of Metro Chinese online adults with a bank account using their mobile banking app at least monthly.

- ATM use declining as digital payments soar. The pandemic has driven consumers toward digital payments. But claims of the death of cash are exaggerated, with 47% of Metro Chinese online adults having used cash to make a purchase in the past three months. Many bank customers continue to need ATMs or self-service kiosks.

- Fintech and tech giants continue to disrupt the industry with technology.

a. Tech titans are using digital technologies like mobile, cloud, application programming interfaces, real-time data, and flexible architecture to enable collaboration and together build broader platforms and ecosystem businesses.

b. Disruptors are making both domestic and international payments faster and easier for consumers and businesses alike. Fintech firms such as Stripe offer modular technology components to help other brands embed financial services into their proposition. Others are offering tech to convert mobile devices into mobile point-of-sale terminals, enabling small merchants to accept card payments.

c. Deferred-payment providers are offering instalment options, revolving credit, and others schemes to ease customer credit options. - Many banks now acknowledge that digital transformation is never-ending. According to Forrester’s data, 35%of global decision-makers at banks surveyed cited that their organization were expanding their digital transformation and 19% indicated they were currently transforming. Security was also a concern, with 25% of decision makers at banks surveyed indicating that security was among the biggest obstacles to executing their digital transformation.

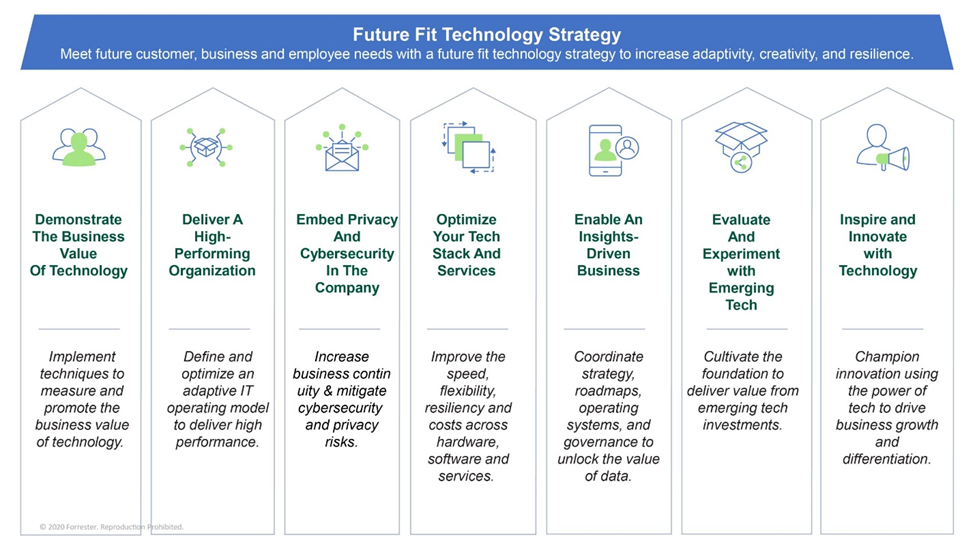

The report concludes that “the economics of the next decade will challenge banks to adopt a future fit technology strategy—rooted in customer obsession and enabling an unprecedented level of adaptivity, creativity, and resilience—or fail.