The trend happened amid crypto curiosity, inflationary defenses, regulatory uncertainties and cybersecurity risks up to early February 2022.

In online surveys conducted between 23 Nov 2021 and 4 Feb 2022 conducted in 20 countries across 29,293 adults aged 18 to 75 with household incomes of US$14,000 or more, 2021 was found to be a year in which ownership of cryptocurrency nearly doubled.

The ratios of crypto owners who were first time buyers were: United States (44%), Latin America (46%), and APAC [Australia, Hong Kong, Indonesia, India, Singapore] (45%).

Additionally, as far as the sample data was concerned, developing countries Brazil and Indonesia led the way in crypto adoption, with 41% of respondents in each country reporting owning crypto, compared to just 17% across developed countries and regions including the US (20%), Europe (17%), and Australia (18%).

Key findings

Notwithstanding the recent spates of increasingly alarming multimillion-dollar crypto scams and cybersecurity risks in related crypto investment and speculation, the survey data yields some trends:

- 41% (on average) of crypto owners surveyed globally were first-time buyers in 2021, and 41% of global respondents indicated they were crypto curious (i.e., either interested in learning more or in acquiring cryptocurrency within the next year). More than half of respondents were also first-time buyers in Brazil (51%), Hong Kong (51%), and India (54%) in the surveys.

- Among the ‘crypto curious’, 47% globally were female respondents. Among crypto owners in the survey, women in developing nations led the way in Israel (51%), Indonesia (51%), and Nigeria (50%). In developed countries and regions, female respondents constituted the following: the United States (32%), Europe (33%), and Australia (27%).

- Respondents in countries that had experienced 50% or more devaluation of their currency against the US dollar over the last 10 years were more than five times as likely to indicate they were planning to purchase crypto in the coming year. This included respondents in South Africa (32%), Mexico (32%), India (40%), and Brazil (45%). In Brazil, where the local currency had seen devaluation by more than 200% against the USD, 41% of respondents owned crypto. In the USA, 40% crypto owners surveyed indicated they saw crypto as “a hedge against inflation”.

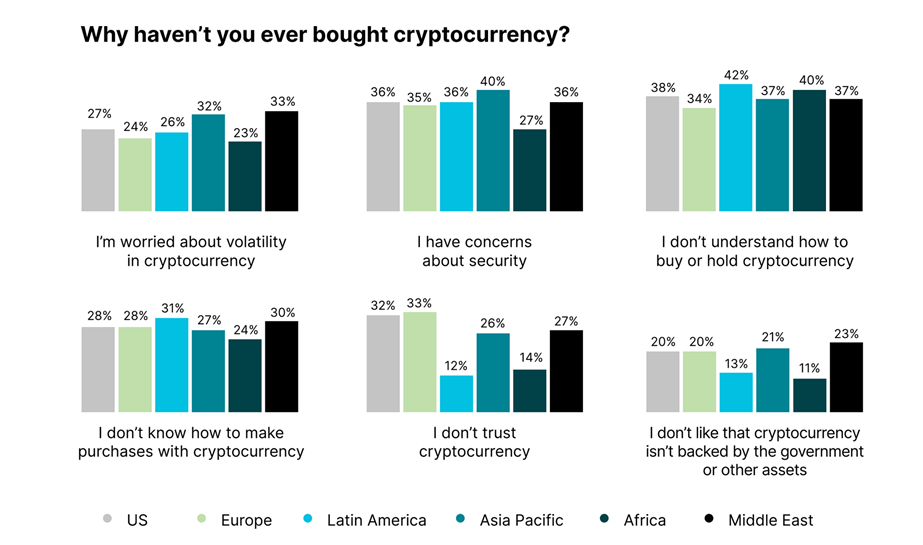

- Legal uncertainty around cryptocurrency was highest among APAC respondents (39%) that did not own crypto, compared to 37% in Latin America, and 36% in Europe. In addition, for 30% of respondents in the Middle East, 24% in Asia Pacific, and 23% in Latin America, tax complexities of owning cryptocurrency had kept them from investing in crypto.

- 40% of respondents (at a global average) indicated that educational resources on cryptocurrency would help them get started with crypto, as compared to 22% globally who preferred recommendations from friends. Also, 51% of Latin American respondents (vs 56% of those in Africa) indicated that educational resources would make them more comfortable purchasing cryptocurrency. For APAC, the sentiment was 44%, and in the United States, 42%.

According to Noah Perlman, Chief Operating Officer, Gemini, which commissioned the survey: “Crypto adoption reached a true tipping point last year. We expect to see the influx of crypto investors continue into this year with concerns about inflation in the USA and globally driving interest. Education also remains a global barrier to adoption, and providing investors additional resources is key to bringing new users into the crypto ecosystem, especially women who make up a majority of the crypto curious audience.”

Note that the survey does not include the global effects of Ukraine-Russia war that happened in late February, which, according to CNBC, have raised major questions over how Russia may use crypto to side-skirt global sanctions, and how hackers on both sides of the war could stage a prolonged series of global crypto heists as part of digital warfare.