Investments, F&B and retail grocery were three industries that were not short-circuited during the five months of Singapore’s pandemic lockdown measures.

Five months after Singapore’s first COVID-19 case in late January this year, the economy is starting to show signs of a slow recovery: businesses are re-opening, and people are adjusting to the clichéd ‘new normal’ as the Circuit Breaker (CB) restrictions ease into Phase 1 of 3.

While COVID-19 has caused dire economic consequences, it has also shone a spotlight on the digital economy, and how consumers and businesses have adapted to the pandemic. In order to help businesses prepare for a post-CB era, consultancy firm Accenture Applied Intelligence tried to identify industry trends and shifts in digital consumer behavior in Singapore.

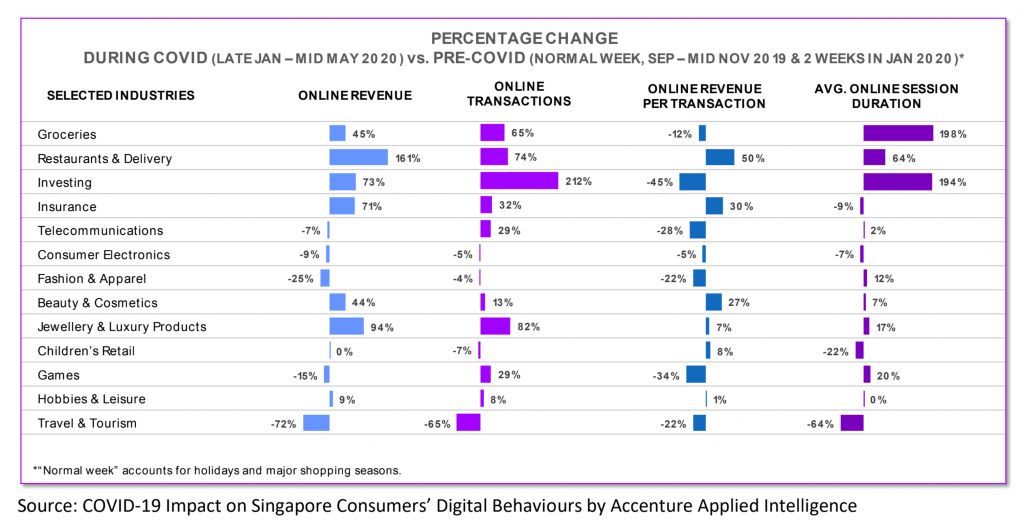

The firm analyzed 20 million online transactions and 3 billion online browsing sessions from a mix of its data partners, news articles and social media data. The chart here is a summary of the findings based on data from 13 industries, which compares the percentage change of online transaction and browsing metrics during COVID and before its outbreak.

Overall, as brick-and-mortar business activities slowed, businesses in some industries such as Investing saw up to three times their normal growth in online transaction volumes and/or revenues.

Singapore consumers’ behavior by industry

- GROCERIES: As online transactions and revenues grew, demand significantly outweighed supply with consumers spending approximately 198% more time online.

- RESTAURANTS & DELIVERY (Restaurants, cafés, fast-food delivery): Revenues climbed more than twice as fast as transactions, with revenue per transaction approximately 50% higher as consumers opted for larger purchase baskets.

- CONSUMER INVESTING (Personal investments in stocks, bonds, funds): Investing transactions increased by approximately 212%, but approximately 45% lower revenue per transaction indicates consumers are making smaller bets.

- INSURANCE (Life, health, commercial insurance): We observed a significant spike in online transactions and revenues for the four weeks following DORSCON Orange, with transactions reaching a peak of 196% above normal in the first week of March.

- TELECOMMUNICATIONS (Telecom mobile services, broadband internet, home entertainment services): Transactions grew up to 29% even as revenues fell, as organizations battled for wallet-share across mobile data, internet and home entertainment.

- CONSUMER ELECTRONICS (Communication devices, home electronics and electrical appliances): Overall revenues shrank by up to 9% as consumers cut back on discretionary spending; that came despite an increased need for equipment and devices required to work from home.

- FASHION & APPAREL: Revenues dropped up to 25% during COVID-19 as cautious consumers reduced discretionary spending.

- BEAUTY & COSMETICS: A shift in consumer purchasing behavior from offline to online resulted in approximately a 44% increase in revenues and around a 13% jump in transactions.

- JEWELLERY & LUXURY PRODUCTS: Online revenues and transactions were largely up, catalyzed by festivals and gifting seasons during this period.

- CHILDREN’S RETAIL (Child apparel, toys, baby care): Revenues and transactions were down since the start of COVID-19 as consumers cut discretionary spending but returned to growth one week before and three weeks into the CB.

- GAMES (Live-streaming and online gaming platforms, board and card games): A surge in revenues observed before the CB was unable to offset the overall decline in revenues compared to the pre-COVID-19 period.

- HOBBIES & LEISURE (Collectibles, crafts, outdoors) − A one-off spike in revenues and transactions was observed at the start of the CB as consumers sought out home-based activities.

- TRAVEL & TOURISM (Airlines, online travel agencies, hotels, car rentals, attractions): Revenues and transactions were down over 90% during the CB.

Emerging from the crisis

Although countries like China, South Korea, Germany, Italy and Spain have begun to ease their lockdowns, fear and caution linger. As Singapore embarks on its gradual three-phase approach to exit the CB, the effects on consumer purchasing behavior in various industries remain to be seen.

Different scenarios could emerge depending on the industry, evolution of the virus and the social response. We could expect that: A) the CB trends continue and persist due to consumer cautiousness and the continuation of existing restrictions into Phase 1; or B) Industries return to DORSCON Orange levels for a few more weeks as restrictions are partially, but not fully, lifted. As organizations prepare for the new normal, here are three actions Accenture recommends for consideration.

Action 1: Accelerate digital transformation and adoption of AI, automation and cloud

The technological infrastructures of many companies have suffered under the weight of the online surge. Organizations must be prepared to redesign their technical infrastructure, processes and systems to withstand future pressures.

Faster adoption of cloud platforms will provide resilience, reliability and the scalability needed to cope with traffic surges and volatility from the increased demand in digital services. Automation must be combined with AI, especially in essential services such as food, supply chains and logistics, to free up time for more complex decision-making. Firms can deploy virtual agents to handle routine customer enquiries, particularly in the finance, travel and tourism sectors which have seen an influx of calls since the outbreak.

Action 2: Gain deeper customer insights and trends

As more consumers go online, they leave larger-than-ever digital footprints like purchase patterns, online interactions and digital content consumption that can be collected and analyzed to gain a deeper understanding of their behavior.

It is more important than ever that organizations harness AI, data and analytics to monitor market trends, needs and sentiments in real-time or near real-time in order to seize opportunities quickly. For example, organizations can leverage internal data, external data and machine-learning to generate “Zero Moments of Truth” that point where the customer is at the very beginning of the decision journey, and identify consumer needs more rapidly in order for businesses to roll out relevant products and services earlier.

Action 3: Exercise corporate social responsibility

Since the COVID-19 outbreak, many companies in Singapore have stepped forward to help communities cope. Grocery retailers set up mobile stores to bring essential items closer to selected neighborhoods, and supermarkets and banks launched priority hours for the elderly and disabled.

Banks provided liquidity relief support and loan moratoriums to small and medium-sized enterprises, while telco companies distributed laptops to needy students for home-based learning. More than 280 organizations have joined the SGUnited Traineeships Program to equip graduates with relevant work experience while the market recovers.

Organizations that take a leadership role in positively contributing to society will become trusted and respected brands in the longer-term. They will ultimately emerge as winners in the eyes of the consumer.