|

Tokyo is still the most popular city to investors

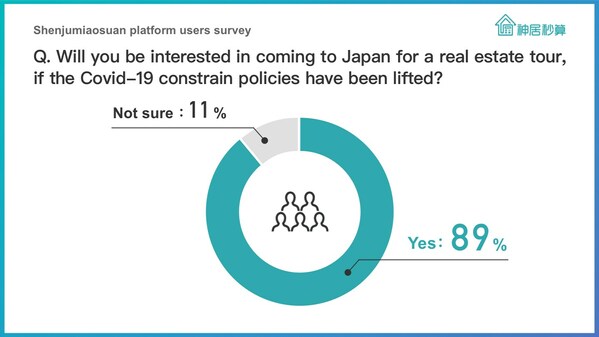

TOKYO, Feb. 9, 2023 /PRNewswire/ — Shenjumiausuan released a research result recently on “the interests of investing in Japanese real estate from Chinese investors” that 89% of Chinese investors are interested in going for a house-viewing tour if the overseas traveling market reopens. Shenjumiausuan (Headquarters: Tokyo, Japan, CEO: Jie Zhao) is one of the sub-companies of the GA technologies group; it runs the biggest platform service which provides Japanese real estate information mainly to customers in Mainland China[1], Taiwan, and Hong Kong. It is part of the GA technologies group, a real estate business corporation in Tokyo, Japan (Headquarters: Tokyo, CEO: Ryo Higuchi, Securities code: 3491).

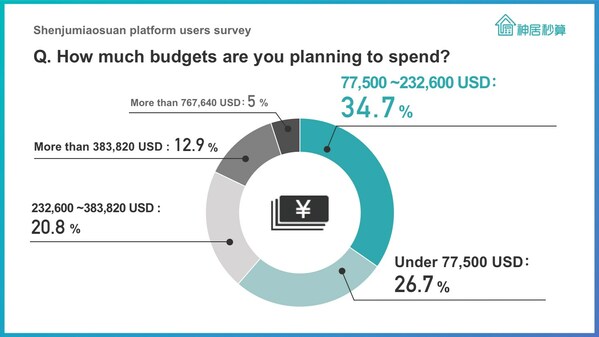

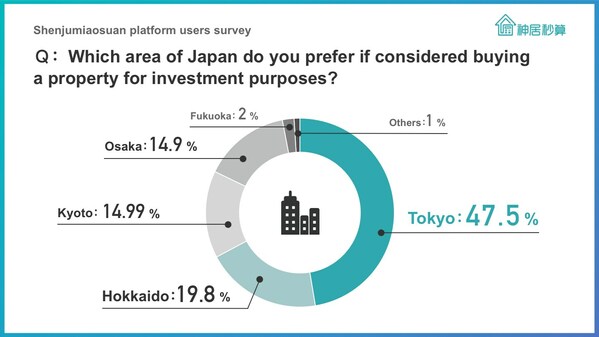

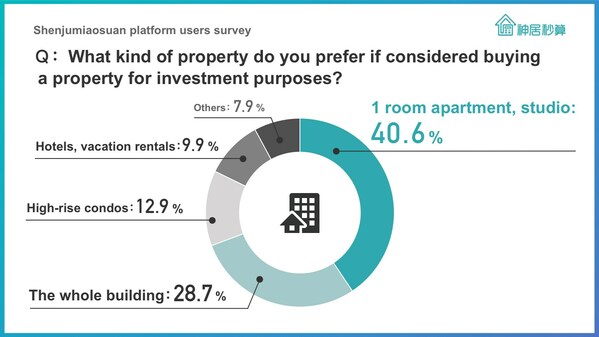

The online questionnaire was carried out among 100 platform users asking about their interests in investing in Japanese real estate. From the result, we could see that the interests of Chinese buyers are still high even after 3 years since the outbreak of the pandemic and with all the traveling restrictions. Major cities like Tokyo, Hokkaido, Osaka, and Kyoto are still the most popular among Chinese investors. The average budget willing to spend is between 77,500 USD~232,600 USD (34%); one-room layout apartment/studio is still the most popular for investment purposes (40.6%), the whole building option comes in second (28.7%), and the high-rise condos come in third (12.9%). Chinese investors’ interest in investing in Japan’s real estate market is still strong. Therefore, the impact due to the pandemic on our business is limited.

|

[1] “Number of listings (portal site for inbound real estate investment(April 2020~)” researched by Shenjumiausuan(former NeoX Co., Ltd.) |

Key Highlights

- 89% of Chinese investors say that they are interested in going to Japan for a house viewing tour if traveling overseas is possible.

- 34.7% of the investors are willing to spend around 77,500 USD ~ 232,600 USD (10 million yen~ 30 million yen) to purchase a property for investment purposes.

- Major cities are still the most popular locations to investors. The list is as follows: Tokyo (47.5%), Hokkaido (19.8%), Osaka, and Kyoto regions (14.9%).

- When asking about the type of property you are interested in, the list is as follows: single-room layout apartment/studio (40.6%), whole building option (28.7%), and high-rise condos (12.9%).

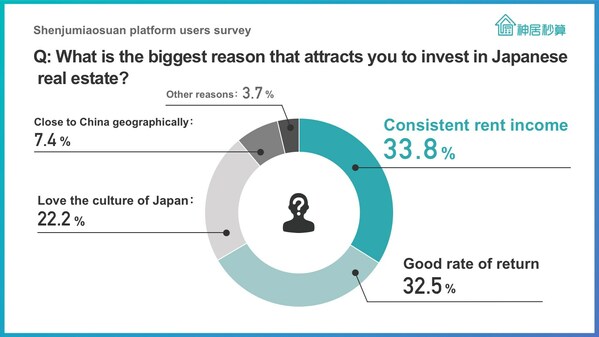

- Major reasons for investing in Japanese real estate: “consistent rent income” is the biggest reason (33.8%), and “good rate of return” comes in second (32.5%).

89% of the Chinese investors answered that they are interested in going to Japan for a house viewing tour if the overseas traveling market reopens

The Chinese government has announced the Covid-19 restrictions (constraints) would be lifted on January 8th, 2023. All restrictions for travel (national & International), long-distance moving, and going outside would no longer be applied. People in Mainland China welcomed a pandemic-restrictions-free Lunar New Year holiday in the three years since the outbreak of the pandemic in 2020. The Lunar New Year holidays fell between 1/21~1/27 this year. And according to Trip.com, the biggest online booking platform in Mainland China, bookings jumped 6.4 times more than last year (2022). Japan is also the No.3 most popular travel destination among Chinese customers (Mainland China). As we could possibly predict, as the restrictions have all been lifted, more people from Mainland China will be more willing to come to Japan for a house-viewing tour.

Most investors are willing to spend around 77500 USD ~ 232,600 USD as for budgets

- 34.7% answered with 77,500 USD ~ 232,600 USD (10 million yen~30 million yen)

- 26.7% answered with under 77,500 USD (under 10 million yen)

- 20.8% answered with 232,600 USD ~ 383,820 USD (30 million yen~50 million yen)

Big cities with more population are still the preferred options when it comes to property for investment purposes

“Tokyo” tops the list with 47.5% of investors preferring it. 19.8% answered “Hokkaido“, and 14.99% chose “Osaka” and “Kyoto” regions. 2% of the investors choose “Fukuoka“. From the answers, we can see that big cities with more population are still popular choices for investors when thinking about buying a property for investment purposes.

One-room studio type of property for rental is still the most popular among investors

Single-room layout apartment/studio is the most popular (40.6%). The whole building option is the second most popular (28.7%). 12.9% preferred High-rise condos.

“Stable profit of return” is the biggest reason that attracts investors to Japanese real estate

What attracts Chinese investors to be willing to invest in Japanese real estate is “stable profit of return” which, no surprise, is the top reason. 33.8% of the investors want to invest in Japanese real estate for “consistent rent income”. 32.5% answered that they would like to invest in Japanese real estate because of the good rate of return.

According to a report (“Index of cost to rent price of International real estate market) released by Japan Real Estate Institute that the total cost of purchasing real estate in Tokyo (apartments/luxury mansions) is cheaper compared to other major cities in the world such as London, New York, Hong Kong, Singapore when the rate of return is better compared to these cities.

Result Summary

Research time period: September 6th, 2022, ~ November 21, 2022

Targets for research: Shenjumiausuan platform users (100 practical answers received)

Research method: Online questionnaire

Shenjumiausuan Co., Ltd.

The business concept of Shenjumiausuan is “to bridge the users from all over the globe by the power of technology”. The service mainly targets customers living in the Chinese cultural regions. The accumulated number of page views is about 4,500,000 views, with about 1,100,000 unique users’ access. (By 2022). It is one of the most popular Japanese real estate service sites that is receiving attention from Greater China.

Shenjumiausuan Co., Ltd.

Representative: Jie Zhao

Website: https://www.shenjumiaosuan.com/company

Headquarters: 40F of Sumitomo real estate Roppongi Grand Tower, Roppongi 3-2-1, Minato-Ku, Tokyo

Year of founding: December 2016

Capital fund: 5,000,000 yen

Service: Real estate service platform “Shenjumiausuan” targets customers living in the Greater China regions

GA technologies Co., Ltd

Representative: Ryo Higuchi

Website: https://www.ga-tech.co.jp/

Headquarters: 40F of Sumitomo real estate Roppongi Grand Tower, Roppongi 3-2-1, Minato-Ku, Tokyo

Year of founding: March 2013

Capital fund: 7,238,798,466 yen (by October 2022)

Services:

- Internet real estate marketplace business: RENOSY

- BtoB PropTech SaaS development

GA technologies group: ITANDI, RENOSY PLUS, Shenjumiausuan, and 12 other group companies

Please contact us through the following information

GA technologies P.R. team: Hayata, Judy (+81-80-8899-1699)

Mail: pr@ga-tech.co.jp