Nearly half of small-to-medium-sized enterprises in the Asia Pacific region indicated optimism in the largest global survey to date.

A new global report by Facebook, in partnership with the Organisation for Economic Co-operation and Development (OECD) and the World Bank, has shown that 61% of small- and medium-sized enterprises (SMEs) in East Asia & Pacific have reported a fall in sales due to global pandemic, but nearly half of such business owners in the region remain optimistic about their future outlook.

The State of Small Business Report is one of the broadest surveys of the economic impact on small businesses to date, comprising responses from nearly 30,000 businesses across 50 countries. It paints a sobering picture of the pandemic’s effect on SMEs and delves into the owners’ perceptions and the areas where they feel they need the most support.

According to Dan Neary, Vice President of Asia Pacific, Facebook, the coronavirus has hit SMEs everywhere and many have had to close and, for others, it has become much harder to operate. “The report shows that many are pivoting quickly to adapt to the new normal. This includes an increasing shift to online channels and marketing to leverage new trends and consumer behavioral changes. So, while the pandemic is having a very real impact on businesses, nearly half of the (SMEs) surveyed are optimistic about the future.”

Broad spectrum findings

Statistics in five key areas show the extent of SME’s prospects.

- Survival and closure rates

- Between January and May 2020, 18% of East Asia and the Pacific SMBs had to close, as compared to the global average of 26%. In South Asia, the impact was harder, with 46% of SMEs failing.

- Within the region, large variations were observed, with countries such as Taiwan witnessing only 4% of SME failing, as compared to 31% in Singapore. According to the report, these rates tie in to how stringent lockdown measures were—which in turn were affected by the rate of infections and local government measures.

- Closure rates also varied between industries. Globally, the worst-hit were tourism agencies (54%) hospitality and event services (47%), education and child care services (45%), performing arts and entertainment (36%), and hotels, cafes and restaurants (32%).

- Closures also disproportionately affected female-owned SMEs. In the East Asia and the Pacific region, 22% of female-owned SMBs have had to close, as compared to 16% of male owned businesses: this is largely the result of female-owned SMEs being more likely to specialize in the more-affected industries, such as personal grooming.

- Between January and May 2020, 18% of East Asia and the Pacific SMBs had to close, as compared to the global average of 26%. In South Asia, the impact was harder, with 46% of SMEs failing.

- Economic effects on sales and revenue

- A considerable drop in demand for goods and services offered by SMEs was noted, with 61% of East Asia & Pacific SMEs reporting a fall in sales (in line with global average of 62%).

- Even in countries with low levels of government-mandated closures, like Taiwan (which saw only 4% of SMBs failing), 28% of SMBs reported a drop in sales of over 50%— suggesting that businesses that remained open during the pandemic had endured similar circumstances, irrespective of the severity of lockdown restrictions in the relevant country.

- A considerable drop in demand for goods and services offered by SMEs was noted, with 61% of East Asia & Pacific SMEs reporting a fall in sales (in line with global average of 62%).

- Access to finance

- In East Asia and the Asia-Pacific region, 29% of businesses were receiving financial support in response to the COVID-19 pandemic at the time of the survey.

- Globally, around 60% of support was in the form of government grants (49%) or governmental loans (10%).

- Where support was available, SMEs often cited a lack of information as the biggest challenge in accessing financial aid.

- In East Asia and the Asia-Pacific region, 29% of businesses were receiving financial support in response to the COVID-19 pandemic at the time of the survey.

- Domestic and family responsibilities

- One area that gets often overlooked in understanding the impact of COVID-19 on SMEs is increased demands on business owners to also balance domestic responsibilities as a result of containment measures. This is particularly impactful on female business owners, with 23% saying they spend more than six hours on domestic responsibilities as compared to 11% of male business owners.

- Unsurprisingly, in those countries where business leaders spent more time on domestic responsibilities, more business leaders also reported that these responsibilities were having an impact on their work.

- One area that gets often overlooked in understanding the impact of COVID-19 on SMEs is increased demands on business owners to also balance domestic responsibilities as a result of containment measures. This is particularly impactful on female business owners, with 23% saying they spend more than six hours on domestic responsibilities as compared to 11% of male business owners.

- Future expectations

- From the 26% of the global pool of SMEs that failed, nearly three quarters (74%) reported that they expect to reopen. Some 47% cited the lifting of COVID-19 containment measures as the most important factor in any decision to reopen.

- In terms of specific challenges, the three most commonly-foreseen challenges among regional business owners for the upcoming months included a lack of demand (45%), cash flow constraints (40%) and repaying outstanding loans (21%).

- Despite the mixed forecast, the level of optimism in the region remained high with nearly half of all regional SMEs reporting that they felt optimistic about the future. However, levels of ‘optimism’ varied widely across the region, with business owners in Indonesia (67%) and the Philippines (64%) feeling optimistic, compared to countries such as Japan (14%) and South Korea (32%).

- From the 26% of the global pool of SMEs that failed, nearly three quarters (74%) reported that they expect to reopen. Some 47% cited the lifting of COVID-19 containment measures as the most important factor in any decision to reopen.

SME needs and policy recommendations

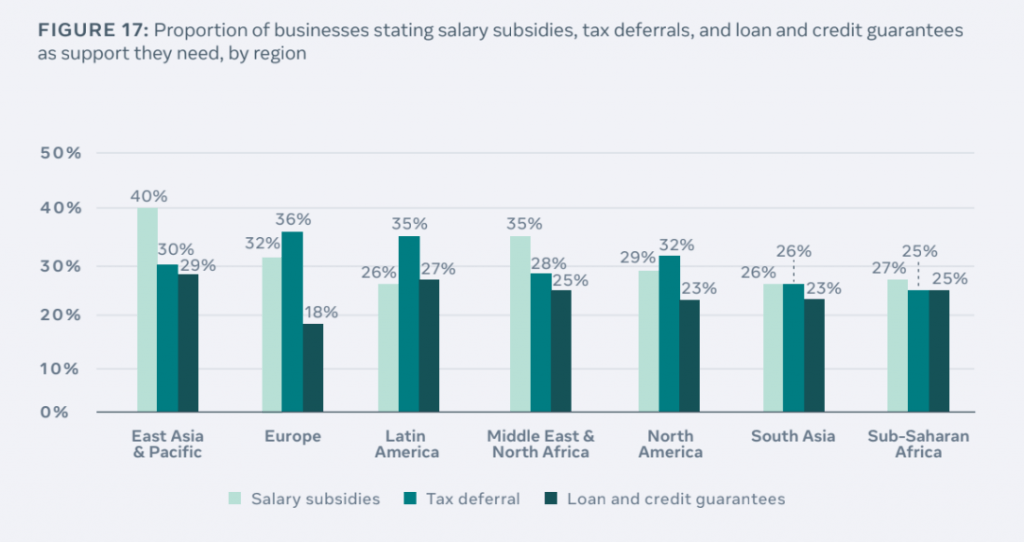

The report has attempted to identify tangible areas of support for SMEs as they move from surviving to recovery and rebuilding during this challenging time. In general, SMEs still require further support in the short term and the three most critical policies to support their business in Asia SMEs are salary subsidies (40%), tax deferrals (30%), and access to loans and credit guarantees (29%).

Other measures cited by respondents also included rental or loan repayment deferrals and utility subsidies.