Guess which little island pulls its own weight when it comes to expectations of fast, reliable digital customer service and support…

As customer expectations continue to evolve, businesses are clamoring to make sense of the big factors influencing rapidly changing consumer behavior patterns. In that regard, a recent Customer Experience (CX) Trends Report by customer engagement specialist Zendesk has shown us some interesting insights to digest.

The report is based on industry research and product usage data from 45,000 customers worldwide, including supplementary data from Southeast Asia, where one country stands out from the rest: Singapore.

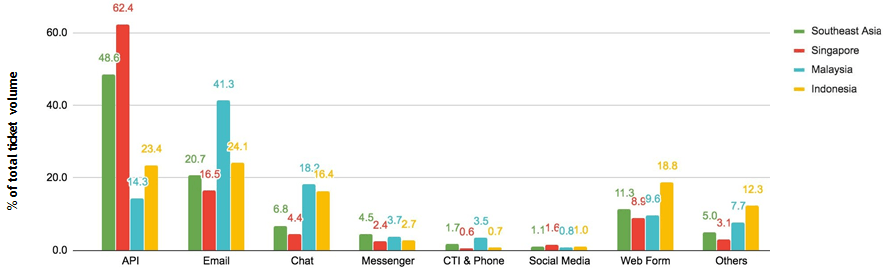

The small and densely populated island stands at the forefront of the regional cohorts demanding a convenience economy. While only 48.6% of the rest of Southeast Asia dreams of adopting AI-enabled customer support for resolving support tickets, 62.4% of Singaporeans expect it in their fast-paced lives.

Southeast Asia refers to Singapore, Malaysia, Indonesia, the Philippines and Thailand

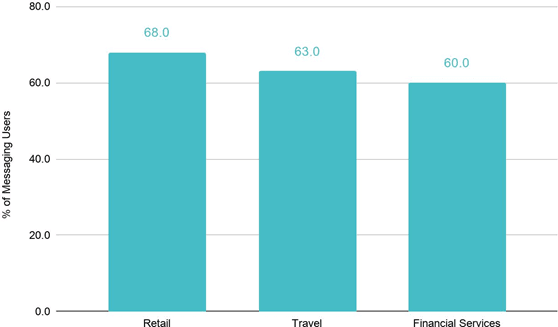

Furthermore, 86% of Singaporeans have online access, and 76% are active on social media and mobile subscriptions—among the world’s highest numbers of connected consumers. In fact, the little city state is the global lead in delivering a seamless service experience, especially in retail (68%), travel (63%) and financial services (60%)—which are also among the top industries in Southeast Asia to adopt messaging channels (e.g. WhatsApp and LINE) for customer engagement.

In contrast, Chat is the dominant self-help channel for Malaysians (18.2%) and Indonesians (16.4%), reflecting how consumer behavior is being shaped by mobile-first economies.

What is elevating CX performance across SE Asia?

Convenience is at the top of consumers’ minds, and the Zendesk research shows that brands are becoming increasingly savvy about how they sell to and reach buyers. Empowered customers with high expectations are constantly comparing experience and rating services, and this can make or break a brand’s competitiveness. In Singapore, customer-centric brands such as Circles.Life and StashAway are optimizing their teams with AI-enabled tools and insights to deliver a seamless and unique experience. To remain competitive, businesses must combine customer feedback with strategic business efforts that offer the most impactful brand differentiation.

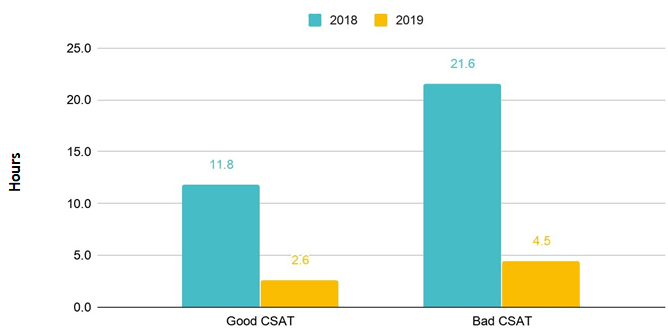

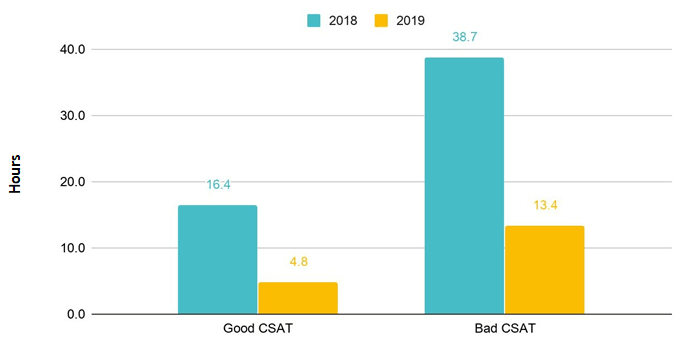

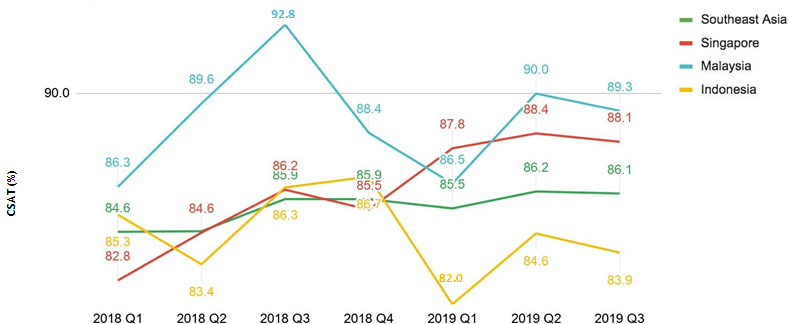

When it comes to service, the top priority for customers is speed—they want their issues solved quickly and effectively. As AI-enabled customer support continues to thrive in Southeast Asia, Zendesk’s research found that improvements across various performance metrics have more than doubled in the past year. For example, the ideal first reply and resolution times dropped from 11.8 hours to 2.6 hours (Fig. 3), and from 16.4 hours to 4.8 hours (Fig. 4) respectively. These improvements—while significant in just one year— only translate to a +0.2% year-on-year improvement in Southeast Asia’s Customer SATisfaction (CSAT) score (86.1%), reinforcing that rate at which customer expectations are rising is exponential.

First Reply Time metric measures the time between ticket creation and the first public comment reply by an agent.

Resolution Time metric measures the duration between ticket creation and its first resolution.

Said Malcolm Koh, CX Strategist APAC, Zendesk: “AI-enabled support driven by insights from customer data has opened new doors for brands like Bukalapak and Minor Hotels to deliver more personalized experiences. Improvements in insights and analytics can mean that Southeast Asia’s businesses are becoming more proficient at managing customer data, substantially improving customer experience and loyalty. In fact, research from Forrester found that when customers are engaged in the right way, with the right emotion, they are even willing to pay a premium.”

Customer Satisfaction (CSAT) in Singapore vs Southeast Asia

Singapore’s aggressive rollout for digital readiness and transformation has a tangible impact on the nation’s overall customer satisfaction (CSAT). As local businesses become better at engaging with customers via digital channels, the data shows that CSAT scores have risen by 5.3% to peak at 88.1% over the past two years, dominating the region’s average of 86.1%. However, despite being ahead in digital maturity, Singapore currently lags behind Malaysia (89.3%), whose consumers are still contented with the benefits from the later adoption of customer support technology.

Southeast Asia refers to Singapore, Malaysia, Indonesia, the Philippines and Thailand

Despite a decline towards the end of 2018, Singapore saw a commendable uplift in CSAT scores, cementing the nation’s competitiveness against its regional peers. According to Koh: “The key to high performing CX teams is a robust AI strategy backed by data insights and automation to effectively scale support. Looking forward, businesses across Southeast Asia will need to examine how AI can permeate more channels—including social media—for customers to self-serve, especially in reaching out to a growing demographic of highly discerning Gen Zs.”