Two years of past data showed that this golden window may still hold true in spite of the current pandemic.

About half of all countries around the globe are experiencing an uplift in online sales transactions due to lockdowns and pandemic-related social distancing requirements.

With Ramadan coming up from 23 April to 23 May this year, the surge in e-commerce transactions is expected to rise further as Muslims look online to prepare for the festivities amidst lockdowns and bans that may be extended well beyond May.

Marketing and advertising tech company Criteo has analyzed the trends around Ramadan over the previous years in Southeast Asia (SEA), which includes Indonesia and Malaysia, noting that sales uplift peaked during the third week for 2018 and 2019. Last year, the two countries saw greater traction with a 106% increase, compared to a 90% increase in 2018. Shoppers were also more active the week before Ramadan and the first week of Ramadan in 2019 compared to 2018.

This reveals a shift in consumer behavior—an increase in last-minute buying right before the start of festivities. Given this year’s projected spike in online transactions due to global lockdowns, e-commerce players should prepare for unprecedented sales surges.

Said Pauline Lemaire, Criteo’s Director of Account Strategy for Large Customers, SEA, Hong Kong and Taiwan: “With the increased reliance on e-commerce during this time, brands and retailers must ensure that their logistic networks and fulfilment capabilities are robust enough and inventories are well-stocked to meet the growth in demand and volume of transactions.”

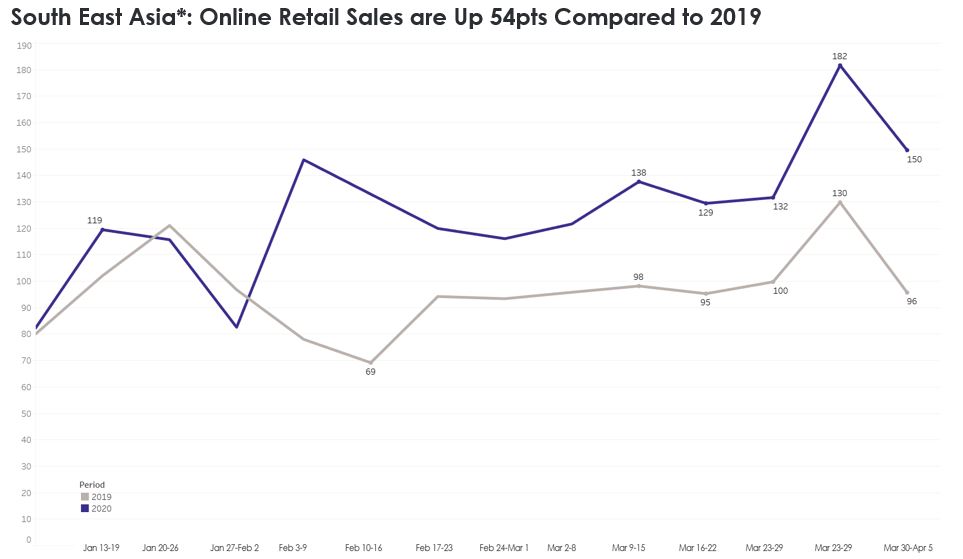

Based on Criteo’s data on the impact of the pandemic in the Asia-Pacific region, online retail sales in SEA is experiencing a higher uplift this year compared to 2019, with the highest sales uplift seen in the week of 23 March at 82%.

While this number is expected to rise with the upcoming Ramadan celebrations, Criteo is predicting that shoppers will be prioritizing more on what they need in this social distancing economy and not just for the religious festival.

Past Ramadan shopping data have shown that the top product categories would usually be Health and Beauty, Electronics, Toys and Games and Home and Living. This may deviate slightly during the pandemic.

From 30 January to 5 April 2020, data from multiple markets on overall e-commerce trends has yielded some useful insights:

- Shoppers are spending more on quality-of-life oriented goods for comfort and entertainment to adapt to living almost entirely indoors.

- Grocery items such as seasonings and spices and grains have seen an increase in online sales from 16 Feb 16 to 15 March. Semi-perishable food ingredients have understandably seen the largest increase as consumers are forced to stay home.

- As more consumers adjust to working- and learning-from-home, the consumer electronics segment is seeing a significant growth in online sales globally. This is predicted to continue through Ramadan as the usual practice of in-person prayer and social gatherings will be shifted to digital meetings. This will result in the need for devices to help celebrants carry on traditions.

- Furniture sales saw a global uplift throughout the whole of March this year as more consumers were looking to set up a conducive work environment at home with increased remote working measures. This will foreseeably continue during Ramadan as a majority of consumers will have to stay indoors and will be looking to see how they can make their homes comfortable.

- More consumers are reaching for comfortable clothing as they spend more time at home. This includes buying more apparel which are appropriate for home fitness workouts.

“Brands and retailers need to think about the type of products which can complement an indoor-heavy routine or build an experience in a social distancing economy as more people spend their time at home. It is also critical for brands and retailers to consider how their offerings should be presented at this point in time. For example, ads showing products that are suited indoors should be favoured over those depicting outdoor activities or crowded places,” said Lemaire.

A look at e-shopping timings

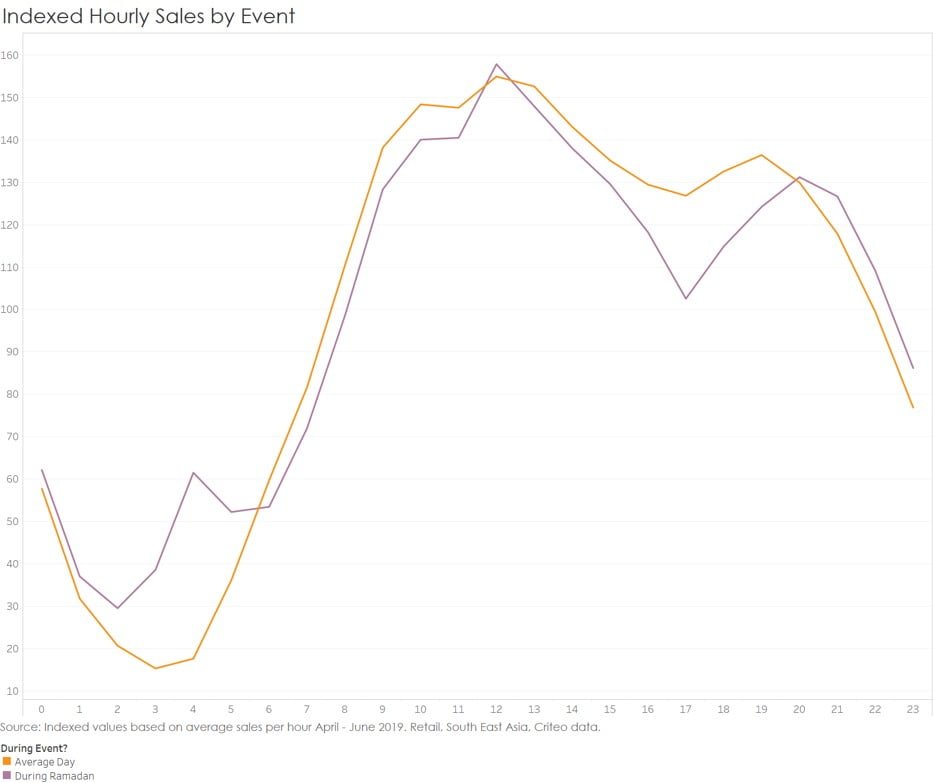

Data is showing that online shopping happens more frequently when the sun is down. Criteo’s Ramadan data has uncovered that online retail activity from Malaysia and Indonesia during Ramadan 2019 surged at 3am daily.

Online web traffic starts to increase at that time indicating that shoppers begin to browse for their purchases when they wake up to prepare for the day. At 4am, retail sales were 3.5x higher on Ramadan compared to an average day. There was a significant drop in sales at 6pm when Muslim shoppers prepared for their first meal after a day of fasting.

Even as desktop sales continue to account for more than 80% of all retail sales, buying from mobile offers consumers the convenience to shop at the palm of their hands. Mobile use increases during Ramadan as consumers use online religious app for prayers, grocery and food delivery services, entertainment and communications apps.

The weekly mobile share in sales surged to 39% during Eid al-Fitr last year. This progressively led to an increase in in-app sales. In 2019, in-app sales grew by up to 83%, indicating that consumers may be moved to buy more within apps when they find an easy, convenient shopping experience.

Lemaire added: “In addition to ensuring enough inventories are available throughout this season, brands and e-tailers should also plan around leveraging this golden hour for transactions. Beyond planning the midnight deals and flash sales, it’s worth considering extending this approach for the 3am-4am window where sales are projected to surge even higher.”

Additional tips for marketers

During this extraordinary year, Lemaire advises businesses to monitor category trends closely: They should focus on expanding segments such as home-based learning, remote-working, home fitness and entertainment. “Drive conversations with today’s context: While creating campaigns is still feasible, it needs to be around products which are most relevant to consumers. Campaign calls-to-action should focus on inventory, last-mile delivery and experience. Engage the audience: explore interactive ad formats to engage with key shoppers as people spend more time at home and are looking to be entertained.”