|

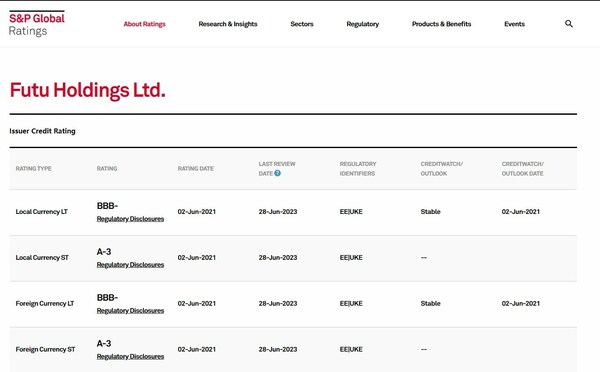

HONG KONG, Aug. 15, 2023 /PRNewswire/ — Futu Holdings Limited (Nasdaq: FUTU, “Futu”), a leading tech-driven online brokerage and wealth management platform, was granted a long-term issuer credit rating “BBB-“, by major global rating agency Standard & Poor’s (S&P), for its third consecutive year.

In S&P’s report, Futu was expected to steadily grow its client base over the next two years, particularly in overseas markets.

S&P believes that Futu will be able to continue serving its existing mainland client base. Futu continues to offer quality trading services to its existing mainland China clients, bringing its operations into full compliance with China regulatory requirements.

Meanwhile, S&P underscored Futu’s good track record of client retention in the last few years. According to Futu’ financial reports, the company’s paying client retention rate has maintained at approximately 98% for 16 consecutive quarters, since its listing on Nasdaq stock exchange in 2019. At the end of the first quarter this year, the number of Futu’s paying clients surpassed 1.5 million and the user base, coming from more than 200 countries and regions, exceeded 20 million.

S&P also mentioned that the expansion of Futu’s product offering and services will enhance clients’ engagement and retention, and bring more stable recurring income streams for the next two to three years.

The rating agency reiterated Futu’s good share in Hong Kong’s retail brokerage market along with strong capitalization and adequate risk controls. With an estimated 10% market share in Hong Kong’s retail stock trading sector, S&P believed the company will continue to leverage its brand name, good user experience, and stable technology infrastructure to support its business growth.

Futu announced its overseas subsidiaries expanded footprints into Canada in August, after its outreach in the US, Singapore, Australia, and other markets. This will bring Canadian investors easy-to-use pro-grade tools, financial data, and investment insights, enabling them to analyze lucrative opportunities in global markets, especially in the US stock market.

About Futu

Futu Holdings Limited (“Futu”) (Nasdaq: FUTU) is an advanced fintech company upgrading the investing experience by offering fully digitalized financial services in multiple markets. Futu was listed on Nasdaq on March 8, 2019. Futu offers market data, financial news, interactive social features, and investor education on its proprietary one-stop digital platforms Futubull and moomoo. Its subsidiaries provide clients with investing services including trading and clearing services for United States, Hong Kong SAR, China Connect, Singapore, and Australia stocks, margin financing and securities lending, and wealth management. By creating an ecosystem centered around its users, Futu provides connectivity to users, investors, analysts, media, companies, and institutions. Futu also provides Employee Stock Ownership Plan (ESOP) solutions, initial public offering (IPO) distribution, and investor relations (IR) and public relations (PR) services through its institutional and corporate services brand, becoming the go-to partner of many well-known companies. Futu Trustee provides one-stop wealth management solutions for corporate clients and high-net-worth individuals and families, and revolutionizes service delivery for ESOP Trust Administration, Family Trust, and Family Office through technology.

Contact: futupr@futunn.com