|

Transactions in Singapore and Thailand are expected to more than double CLI’s funds under management in Southeast Asia to S$1.2 billion

SINGAPORE, Feb. 7, 2024 /PRNewswire/ — CapitaLand Investment Limited (CLI) today announced three new acquisitions in Southeast Asia from unrelated third parties. The acquisitions include two industrial properties in Singapore by Extra Space Asia, the Asia-focused self-storage platform managed by CLI. In addition, CapitaLand SEA Logistics Fund acquired OMEGA 1 Bang Na, Thailand (OMEGA 1 Bang Na), a 20-hectare freehold greenfield site in Bangkok, Thailand.

In January 2024, CapitaLand Wellness Fund completed the joint acquisition of a freehold lodging property in Singapore. Upon the completion of the development of OMEGA 1 Bang Na, the total investment value of these four acquisitions will be approximately S$700 million, boosting CLI’s funds under management in the region to S$1.2 billion.

Ms Patricia Goh, CEO, Southeast Asia Investment, CapitaLand Investment, said: “Despite the challenging market conditions, we have made tremendous progress in deploying capital strategically across Southeast Asia over the past year into assets catering to self-storage, logistics and wellness-hospitality sectors. These sectors have demonstrated strong secular growth in this region and align with our thematic focus of investing in real estate driven by long term mega trends such as rapid urbanisation, supply chain rationalisation, evolving consumer preferences, aging population and longevity economy. The acquisitions not only demonstrate our deal sourcing and execution capabilities but also underscore our extensive reach and scale in Singapore as we leverage these competencies to expand our presence in the region.”

“Looking ahead, these latest acquisitions are set to fuel the next stage of growth for each of these CLI-managed funds. By combining our skillsets of value creation with best-in-class operating capabilities and drawing on the sector-specific industry knowledge of our capital partners and operators, these funds are poised to contribute positively to our fee-related earnings and deliver sustainable returns to our investors. We will continue to identify investment opportunities in Singapore, Thailand and other markets in Southeast Asia, building on our momentum and driving further transformation and growth,” added Ms Goh.

Growing Extra Space Asia‘s (ESA) platform in Singapore with quality solutions

ESA, one of the largest self-storage operators in Asia with 80[1] facilities, is expanding its portfolio in Singapore with approximately 320,000 square feet (sq ft) in gross floor area by the end of 1Q 2024. The proposed expansion includes a freehold industrial asset, and an industrial asset with a long land lease tenure located near Holland Village, a popular residential area surrounded by numerous educational institutions and attractive retail and dining offerings. These properties are strategically located near densely populated residential areas and are well-connected to major transport routes. Upon completion of the acquisitions, ESA plans to convert both assets into self-storage facilities in phases, offering air-conditioned units and facilities for wine storage.

With these acquisitions, ESA’s Singapore portfolio will expand its range of locations and storage solutions. ESA’s properties in Singapore continue to record high occupancies as demand for self-storage remains robust. Plans are also underway to add more green-certified properties to its portfolio. In line with the platform’s value-add strategy, CLI will focus on identifying investment opportunities that can unlock value and maximise revenue from the assets through efficient conversions of industrial spaces for self-storage use.

CapitaLand SEA Logistics Fund (CSLF) expands into Thailand with state-of-the-art automated logistics campus

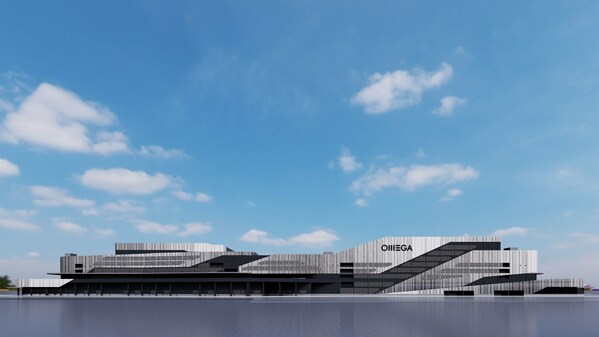

CSLF is CLI’s logistics platform in Southeast Asia and held its first fund close in February 2023. The fund will allocate capital towards the development and management of advanced logistics infrastructure supported by integrated smart warehousing solutions. In December 2023, CSLF acquired its seed asset, a freehold land site, to develop OMEGA 1 Bang Na. This will be CLI’s first logistics property in Thailand.

Located along the Bang Na Trat Highway in Samut Prakan Province, a prime logistics cluster located within the Greater Bangkok Metropolitan area, OMEGA 1 Bang Na offers excellent accessibility to the central business district and key transport nodes such as the Laem Chabang Deep Sea Port and Suvarnabhumi Airport. As a built-to-suit project, CSLF will develop a state-of-the-art automated logistics campus with a gross floor area of 2.47 million sq ft, capable of accommodating over 150,000 pallet positions in an automated storage and retrieval system. This modern ramp-up campus will be Thailand’s largest standalone warehouse and operated by Ally Logistic Property when completed. The campus will comprise two buildings, each featuring ambient and cold storage capabilities, respectively. Construction is scheduled to commence in 1H 2024 with phase one expected to be completed in 2026.

CapitaLand Wellness Fund (C-WELL) grows integrated wellness-hospitality ecosystem with maiden acquisition

In October 2023, CLI announced the first close of C-WELL, its inaugural wellness and healthcare-related real estate fund. Anchored in Southeast Asia, the fund’s initial focus will be on Singapore, Thailand and Malaysia. With a target fund size of S$1 billion on an upsized option, C-WELL will invest in single or mixed-used assets across the healthcare, medical, wellness and preventive care spectrum.

C-WELL and The Ascott Limited (Ascott) jointly acquired a freehold lodging property in Singapore in January. Located in Singapore’s downtown core district within walking distance to both Bugis and Bencoolen MRT train stations, the 308-unit property will be upgraded and rebranded under Ascott’s award-winning lyf (pronounced ‘life’) brand as demand for experience-led social living grows. The property will remain operational throughout the renovation period and be unveiled as lyf Bugis Singapore in mid-2024.

CLI closes new logistics private fund in Japan

Earlier this month, CLI also announced the close of a new core logistics private fund in Japan. The close-ended fund will grow CLI’s fund under management by S$154.8 million[2] (JPY16.5 billion). The fund attracted several prominent institutional capital partners in Japan and has been fully deployed to acquire two freehold and green-certified logistics assets located in Greater Tokyo and Osaka from CLI and its joint venture partner. CLI holds a minority stake in the fund and will continue to serve as the asset manager of the two logistics properties.

About CapitaLand Investment Limited (www.capitalandinvest.com)

Headquartered and listed in Singapore, CapitaLand Investment Limited (CLI) is a leading global real estate investment manager (REIM) with a strong Asia foothold. As at 30 September 2023, CLI had S$133 billion of real estate assets under management, and S$90 billion of real estate funds under management (FUM) held via six listed real estate investment trusts and business trusts, and more than 30 private vehicles across Asia Pacific, Europe and USA. Its diversified real estate asset classes cover retail, office, lodging, business parks, industrial, logistics and data centres.

CLI aims to scale its FUM and fee-related earnings through fund management, lodging management and its full stack of operating capabilities, and maintain effective capital management. As the investment management arm of CapitaLand Group, CLI has access to the development capabilities of and pipeline investment opportunities from CapitaLand’s development arm.

As a responsible company, CLI places sustainability at the core of what it does and has committed to achieve Net Zero emissions for scope 1 and 2 by 2050. CLI contributes to the environmental and social well-being of the communities where it operates, as it delivers long-term economic value to its stakeholders.

Follow @CapitaLand on social media

Facebook: @capitaland / facebook.com/capitaland

Instagram: @capitaland / instagram.com/capitaland

Twitter: @capitaLand / twitter.com/CapitaLand

LinkedIn: linkedin.com/company/capitaland-limited

YouTube: youtube.com/capitaland

Issued by: CapitaLand Investment Limited (Co. Regn.: 200308451M)

Important Notice

This announcement and the information contained herein does not constitute and is not intended to constitute an offering of any investment product to, or solicitation of, investors in any jurisdiction where such offering or solicitation would not be permitted.

|

[1] Including the acquisitions of the two industrial properties in Singapore. |

|

[2] Based on the exchange rate of 1JPY to S$0.00938. |