Data from February 2023 reveals that travel intent and bookings in APAC continues to register strong rebound with travel demand hitting pre-pandemic levels.

February 2023’s highlights from Skift’s Travel Health Index reveals optimistic growth from Asia Pacific as the region overtakes Europe, boosted by travel demand on the back of the Lunar New Year

Criteo S.A. and Skift Research have partnered to launch the Travel Health Index, which allows the industry to better understand the growth of travel around the world, including in Asia Pacific (APAC).

The Skift Travel Health Index revealed that travel performance in APAC overtook Europe in February 2023. APAC, which had been considered the “black sheep” for a long time, displayed a speedy recovery thanks to the Lunar New Year and the re-opening of China.

In contrast, travel performance in Europe was impacted by cancellations in Turkey due to earthquakes. The Skift Travel Health Index now stands at 93 and is not far away from full recovery, compared to a baseline reading of 100 for the same month in 2019.

“As the pandemic recedes, travel intent and bookings are increasing across the Asia Pacific region. The travel industry is rebounding strongly, with hotel bookings surpassing pre-pandemic levels and rates rising beyond previous levels, indicating robust consumer demand,” said Taranjeet Singh, Criteo’s Managing Director for Enterprise, APAC. “This is an exciting time for the travel industry, and Criteo is committed to supporting it with our real-time measurements and valuable insights through the Skift Travel Health Index.”

Businesses in the region can use data from the Index to adjust their marketing strategies and cater to popular destinations and travel preferences of consumers.

APAC travel demand hits pre-pandemic levels

The travel industry in Asia Pacific witnessed strong recovery, with increased travel intent leading to more bookings and hotel occupancy rates surpassing pre-pandemic levels. The region took the top spot in February 2023’s Travel Health Index, boosted primarily by an increase in 75.8% of trips from travelers in China to Southeast Asian countries during the Lunar New Year. Turkey was an exception as the earthquake had a significant impact on travel performance, resulting in a major decline.

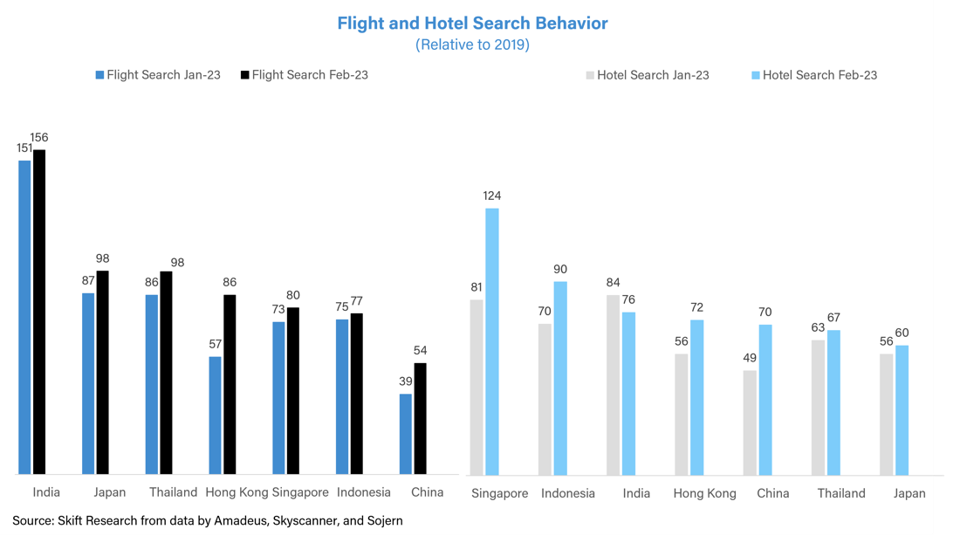

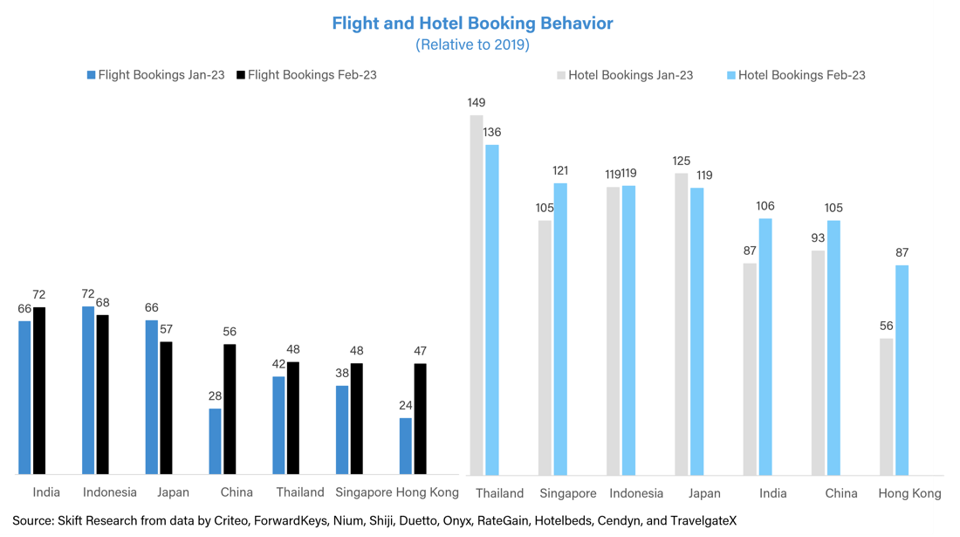

Flight and hotel searches increased for all APAC countries in February except for India, where hotel searches dropped. Within the region, flight and hotel bookings have witnessed a month-on-month increase by 15 percentage points (pp) and 7pp respectively and hotel bookings exceeded pre-pandemic levels by 7pp.

The growth in international flight bookings was a key driver of growth in the region’s flight booking index. Tour groups from mainland China resumed traveling to Singapore and Hong Kong, while Japan has not yet received such groups. Except for Hong Kong, all countries in the region experienced hotel bookings higher than those of February 2019. Hong Kong’s hotels experienced the highest month-on-month growth in the region.

Hotel rates in APAC have gone up more than pre-pandemic levels for all countries except for Hong Kong, which experienced a 120% increase in 2022. Countries like Thailand and Singapore saw an increase in demand from Chinese tourists, while the reopening of Japan’s international border and the National Travel Support campaign helped increase the average daily rates. Singapore’s hotels earned 40% more revenue from rooms than in 2019. Although the overall hotel prices have improved, there is still room for growth. According to TravelgateX data, hotel prices for the Chinese group segment were 20% above the global average before the pandemic. As of February 2023, the global average for groups has exceeded the 2019 levels, but China still falls short by 16%.

Research methodology

The Skift Travel Health Index is a real-time measure of the performance of the travel industry at large, and the core verticals within it. The Index provides the travel industry with a powerful tool for strategic planning, which is of utmost importance as times remain uncertain. Skift Research launched the Index in May 2020 as the Skift Recovery Index, and has rebranded it at the start of 2022 as the Skift Travel Health Index, to reflect some far-ranging changes: the addition of many more indicators, additional data partners, and most importantly, our continued effort to track the industry health beyond the impact of the Covid-19 pandemic.

Skift Research’s methodology extensively analyzes the travel industry by collecting and analyzing data from 22 partners, tracking 84 indicators per country.

The Index categorizes indicators into performance categories and sub-categories, focusing on four travel sectors: aviation, hotel, vacation rentals, and car rental. 22 major tourism economies are assessed, representing a significant proportion of global tourism receipts, outbound tourism expenditure, and GDP. These economies include Argentina, Australia, Brazil, Canada, China, France, Germany, Hong Kong-China, India, Indonesia, Italy, Japan, Mexico, Russia, Singapore, South Africa, Spain, Thailand, Turkey, the US, United Arab Emirates, and the UK.