According to data spotlights from a regional survey, local economic climates and tech savviness levels are big determinants of business growth…

From a Nov/Dec 2023 online survey about business performance conducted across a random sample of 4,222 small business owners/senior managers from organizations with fewer than 20 employees in Australia (501), Mainland China (753), Hong Kong (324), India (505), Indonesia (302), Malaysia (308), New Zealand (303), the Philippines (303), Singapore (302), Taiwan (311), and Vietnam (310), the following regional trends were reported.

In the Malaysia cohort, 78% of respondents expected to grow their small business this year — higher than the survey average of 70%. Also, 59% cited seeking external funding for business growth in 2023, reflecting a shift from business survival mode the year before. However, close to 50% cited increasing costs negatively impacting their business. Other data from the Malaysia respondents include: 52% reviewed their cybersecurity posture in the previous six months, compared to the 48% in a similar survey in 2022; mobile apps remained the most popular technology for respondents’ investments in 2023, with almost 50% reporting profitability from such investments.

In the Singapore cohort, 58% of respondents expected their small business to grow in 2024, while 60% expected their local economy to grow this year. Some 47% reported profitability from investments in technology. However, 54% reported losses due to cybersecurity incidents, and 43% had reviewed their cybersecurity posture in the previous six months. Other data from the Singapore respondents include: 53% of respondents were under 40 years of age, lower than the survey population’s average of 46%; 63% of Singapore respondents reported making over 10% of their revenue from e-commerce activities in 2023, up from 36% in a similar survey in 2019.

Two more markets examined

Of the Australia respondents, 53% expected their small business to grow this year, compared to the survey average of 70%. Compared to 2022, 41% of respondents reported business growth in 2023 — down 7% and lowest of all the markets’ respondents. In terms of technology adoption, 27% found such investments profitable: the second lowest in the survey. Other data from this market population include: 39% earned more than 10% of revenue from online sales; 14% experience losses due to cybersecurity incidents in 2023; and 40% had reviewed their cybersecurity posture in the previous six months. Finally, respondents from this market were the second most likely in the whole survey to not use social media for business purposes.

Of the New Zealand respondents, 60% expected business growth this year. Compared to 2022, there was an 18% reduction in respondents reporting business growth in 2023. However, more than half were optimistic about the state of their local economy, compared to 40% in a similar survey in 2022. In terms of technology uptake, this group was the most likely to not use social media for business purposes, and 34% reported earning more than 10% of revenue from online sales compared to the survey average of 62%. In terms of cybersecurity incidents, 12% reported suffering losses from this aspect in 2023, and 38% had cited reviewing their cybersecurity posture in the previous six months. Finally, in terms of age profiling, the NZ respondents belonged to the older age profile of small-business owners surveyed: the data showed these over-50 respondents were much less likely to invest in technology.

What the small-business data suggests

According to Surin Segar, President (Malaysia Division), CPA Australia, which commissioned the annual regional survey: “Young entrepreneurs are driving the momentum on innovation and technology uptake. The survey results have shown over many years that small business with younger entrepreneurs are more likely to be growing, innovating, using emerging technologies and exporting.”

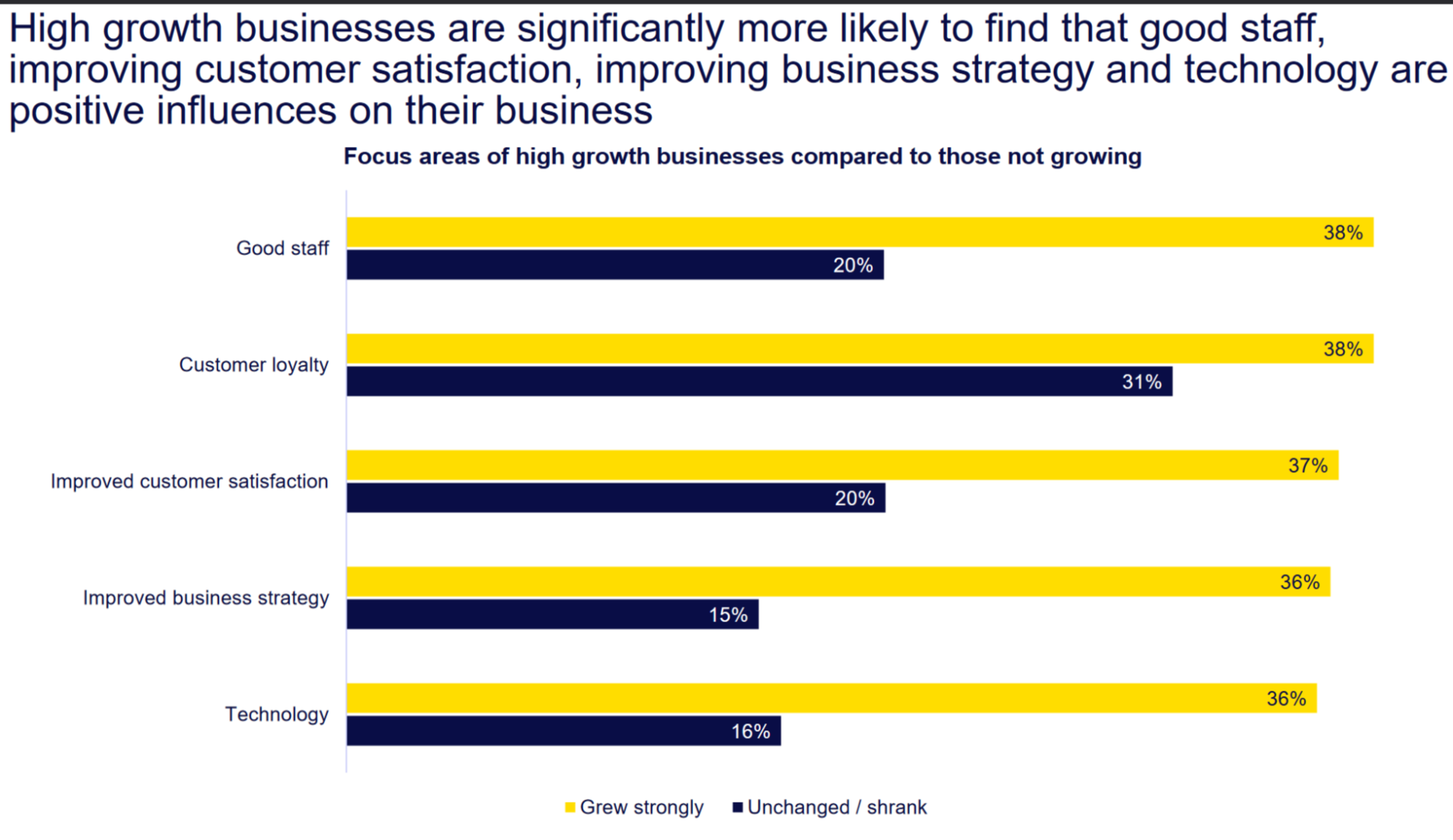

The survey report concludes with observations about the characteristics of high-growth small businesses in the region:

- Technology adoption is critical for strong growth in such businesses

- Those that focus on improving customer experience are likely to experience higher growth

- Innovation and cybersecurity savviness are important traits among the region’s small businesses

- High-growth small businesses in APAC need to focus on entering new markets and growing exports

- Fast growing small businesses are much more inclined to seek professional advice – especially from IT and business consultants (42%)

- Small businesses experiencing strong growth are much more likely to have owners or managers under 50, have been established for five to 20 years, have between 10 and 19 employees, and be in developing markets

CPA Australia hopes to see more small businesses focus on environmental, social and governance issues such as staff health and safety; supply chain sustainability; diversity and inclusion policies. Added Segar: “We hope to see increased investment in advanced ESG practices such as renewable energy and the adoption of green and sustainable finance opportunities.”