As a small Microsoft study shows, it is not just DX, but ingraining a culture of people-centricity and agile innovation …

In conjunction with Singapore Fintech Festival 2020, Microsoft announced findings that found that more than six in 10 financial services industry (FSI) organizations were accelerating digitalization of their businesses. Among FSI leader (organizations with the most mature culture and sustenance of innovation), this figure rose to 86%.

Based on a survey of 597 regional FSI business decision makers across 15 markets in Asia within a six-month period (before and since the pandemic), Microsoft has concluded that the sector is ahead in its ability to innovate in response to challenges. Specifically, 70% of all FSI organizations polled in the Asia Pacific said that innovation was now a “must” and almost all FSI Leaders (96%) agreed and were actively putting this into practice.

The study asserted that, apart from relying on innovation, FSI organizations were deriving high revenue shares from digital products and services: this stood at 39% and is forecast to rise to 52% in three years. For FSI leader, this stood at 47% today and is expected to rise to 57% in three years.

Assessing the FSI innovation maturity

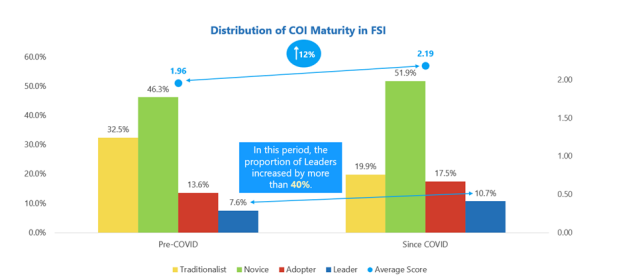

During the current pandemic, FSI organizations matured in their approach toward innovation, via swift pivoting of business processes to raise CX and embrace data management insights to enhance the speed and quality of decision making, the report said.

In addition to that, FSI organizations have integrated cloud technologies to ensure business continuity during a time of remote working and living. In the span of six months, the region’s FSI organizations have apparently matured in the culture of innovation by 12%, which indicates an increased ability to drive sustained innovation.

Putting a culture of innovation into practice

The study revealed best practices that organizations can adopt, referencing the culture of innovation framework, for progress across people, process, data, and technology.

Specifically, organizations are encouraged to:

- Leverage platforms to drive transformation

Moving mission-critical business processes and workloads onto cloud platforms will be key to ensure that innovation scales. Technology architectures will also need to be well-integrated to effectively enable transformation, which will be a key measure of technology Return on Investment (ROI). - Enhance staff capabilities through enterprise-wide skilling initiatives

A diverse cross-industry, multicultural and multi-generational talent base will be key in generating new and disruptive ideas. Beyond that, FSIs need to champion a culture that embraces collaboration, especially with third parties, to create new value. - Utilize data for extreme personalization and rapid value creation

Investing in data will not only enable FSIs to enhance and differentiate products and services, but enable the building of accurate, trusted and secure data sources for prompt and reliable decision-making. This will enable personalization and real-time insights. - Integrate automation within processes to empower continuous innovation

Automation will be key especially for business processes that have high implications for CX, to accelerate the enablement of enterprise-wide collaboration and knowledge sharing. Processes will also need to account for a way to ensure a formal and systematic approach to driving innovation and incorporating this within operations for sustained impact.

According to Connie Leung, Regional Business Lead, Financial Services, Microsoft Asia, as FSIs continue to forge ahead in a post-pandemic world, lasting transformation will only take place if FSIs prioritize people and culture alongside investments in technology. This is key to ensuring greater collaboration and continuous transformation.