The pandemic-driven drive to embrace cloud computing has resulted in four successive quarters of year-on-year growth globally.

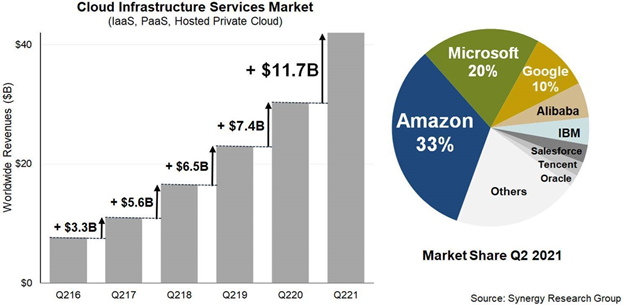

According to recent research, enterprise spending on cloud infrastructure services reached US$42bn in Q2 2021, having increased by US$2.7bn from Q1, and up 39% from the Q2 2020.

For the fourth successive quarter, the year-on-year growth rate had increased. In previous quarters Microsoft and Google had been slowly gaining ground on Amazon, but after achieving 10% growth from the previous quarter Amazon’s worldwide market share had nudged back up to 33%, according to new data from Synergy Research Group.

In Q2, Microsoft and Google accounted for another 30% of the market and the next twenty cloud providers combined had a 28% market share. There then follows a long tail of small-medium sized service providers accounting for the rest of the market. Those with above average growth rates included Alibaba and four other leading Chinese cloud providers.

Synergy Research estimates that quarterly cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) were US$42bn, with trailing 12-month revenues reaching US$152bn. Public IaaS and PaaS services accounted for the bulk of the market and those grew by 41% in Q2.

In the public cloud domain, the dominance of the major cloud providers was even more pronounced, where the top five controlled 80% of the market. Geographically, the cloud market continues to grow strongly in all regions of the world.

Said a chief analyst, John Dinsdale, Synergy Research Group: “This market continues to be a runaway success story for Amazon, Microsoft, Google and some other cloud providers. It must be said that this success is hard earned. Amazon, Microsoft and Google in aggregate are typically investing over US$25bn in capex per quarter, much of which is going towards building and equipping their fleet of over 340 hyperscale data centers. There remains a wealth of opportunity for smaller, more focused cloud providers.”