One annual report on the industry’s business and economic risks asserts that telcos are also exposed to nine other risks

According to an annual EY report on telecommunications risks, the rise in the cost-of-living has driven consumers in several global surveys to readjust spending priorities, and failure to respond to this changing mindset in 2023 is now the biggest threat facing the telco industry.

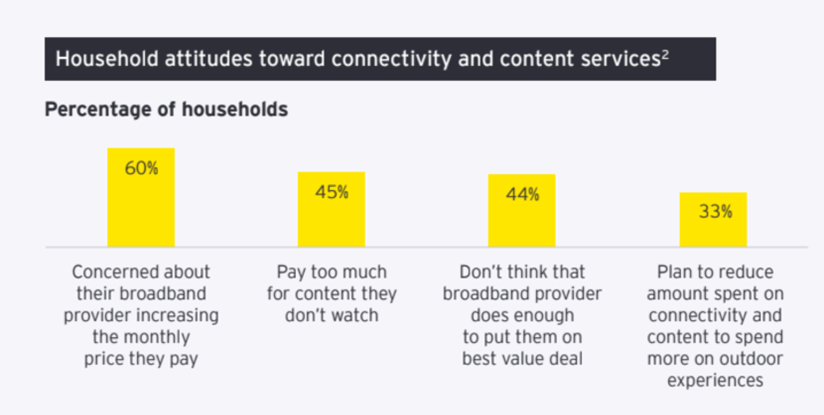

Rising broadband subscription prices and overspending on payments for content services are rattling consumers studied by the firm’s analysts. However, network reliability remains a consumer pain point, and for the first time since the onset of the COVID-19 pandemic, telecom providers’ infrastructure resilience had fallen from top place to fifth position in industry metrics.

Said Tom Loozen, EY Global Telecommunications Leader: “The threat is compounded by increasing pressure from regulators, with some demanding that telcos do more to offer consumers ‘social tariffs’. In response, telcos must create clear, simple and secure propositions that reassure and appeal to customers.”

A similar threat is taking place in South-east Asia, according to another of the firm’s specialists, Joongshik Wang: “With soaring inflation today, customers in the region are likely to be even more sensitive to pricing. We expect continuous pricing war among the telcos as they attempt to defend and gain market share, and the profitability of telcos becomes even more important for players as well as stakeholders.”

Other risks facing Telcos in 2023

According to EY’s research, the Top 10 risks for telcos this year are:

- Insufficient response to customers during the cost-of-living crisis

- Underestimating changing imperatives in security and trust

- Failure to improve workforce culture and ways of working

- Poor management of sustainability agenda

- Inability to accelerate efficiencies through digitalization

- Failure to establish infrastructure resilience and reach

- Failure to take advantage of new business models

- Failure to maximize value of infrastructure assets

- Ineffective engagement with external ecosystems

- Inability to adapt to changing regulatory landscape

Another increasingly urgent threat to the industry is poor management of the sustainability agenda, which has risen from fifth position in last year’s report to fourth place on the 2023 ranking. The firm notes that the quality of telecoms operators’ climate change disclosures has declined year-on-year, and 39% of respondents do not disclose a specific net-zero strategy, transition plan or decarbonization strategy despite growing calls for tangible action from all stakeholders.

Of note in the industry risk ranking is the failure to improve workforce culture and ways of working as the views of employers and employees continue to diverge. While 91% of technology, media & entertainment, and telecoms (TMT) employees surveyed want to work remotely for two or more days per week, 25% of TMT management teams believed their people should return to the office five days a week. Also, workforce churn was a greater threat in TMT: 53% of TMT employee respondents indicated that they planned to leave their current role in the next 12 months, compared with an average of 43% across all sectors.

Said Joongshik: “The average age of South-east Asia’s telco workforce is much (higher) today, and with it means a likelihood of a lower turnover rate with this group. That said, the key talent imperative for telcos players is to attract and retain young talent with digital capabilities to build the future of telco together.”