China’s transactional fee revenue fell to US$255bn as a result of smaller ticket sizes on card transactions and fee concessions.

Based on a global management consulting firm’s proprietary market intelligence recorded in its Global Payments Map spanning more than 25 payments products in 47 countries that together account for 90% of global GDP, 2022 payment revenues had grown by double digits for the second year in a row.

The market in the Asia Pacific region (APAC), which has accounted for around 47% of global payments revenues, grew 4%, as a result of a 3% decline in payment revenues in China. Excluding China, however, APAC payments grew at 25%.

Global liquidity revenues in 2022 accounted for US$750 billion globally, largely driven by the former, and expected to exceed US$3tn in payments revenue by 2027.

The data also showed:

- The economies with the largest payments revenue pools delivered growth at or above the mean, contributing to 2022’s strong results: India, Japan, the United States and Brazil, posted solid results in both interest and fee-driven revenues.

- The volume of India’s digital payments had grown tenfold over the past five years, and this is projected to grow at roughly 35% per year over the next five.

- Emerging opportunities that stand out within the new business-to-business payments market are cross-border payments, financial supply chain alternatives for small- and medium- sized enterprises, and embedded finance.

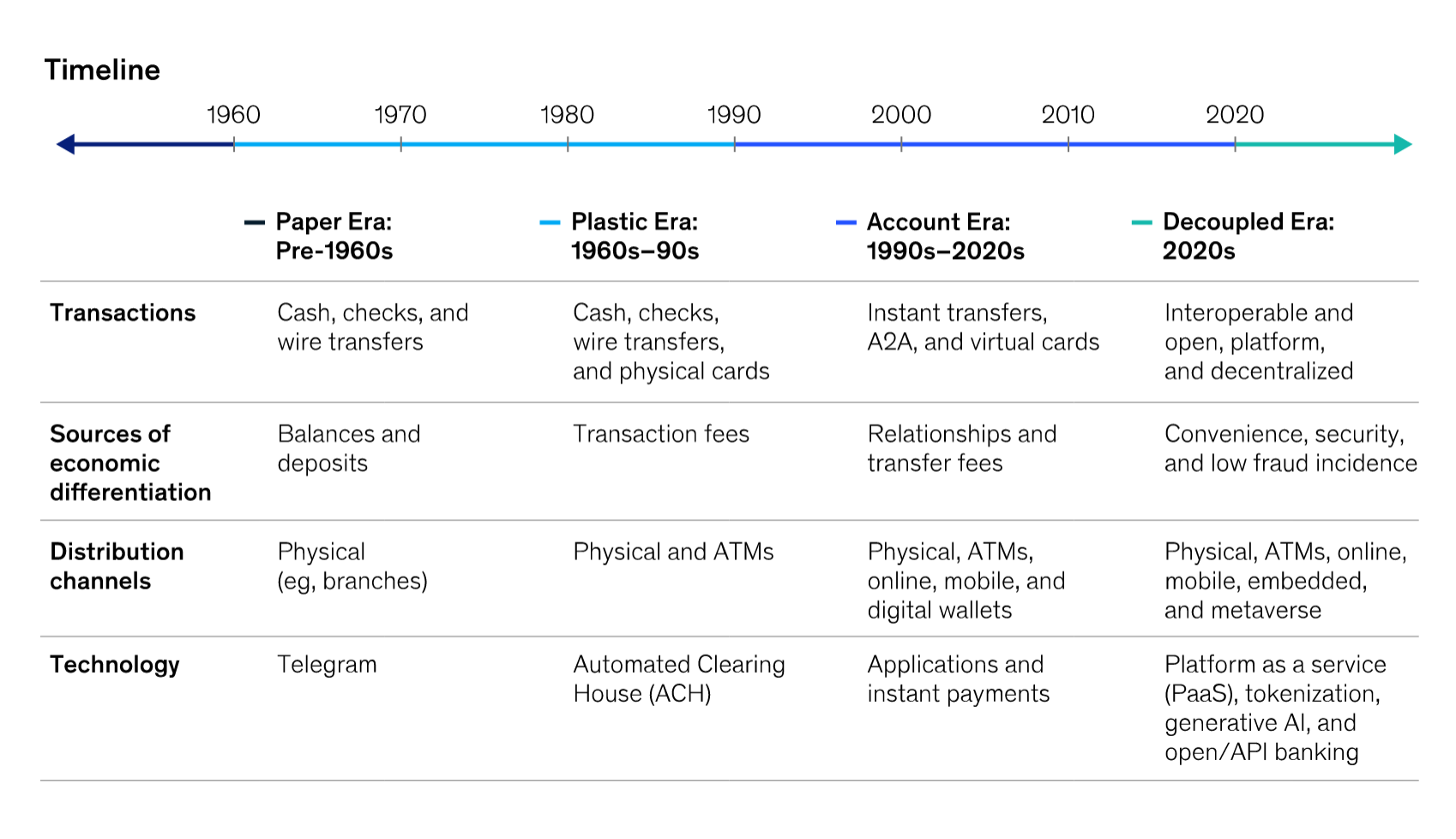

Finally, McKinsey & Company, the firm producing the yearly global payments reports, has surmised that a new “Decoupled Era” could be upon us, where payments may be increasingly disconnected from accounts and other fixed repositories of value.

Compared to users in the “Account Era” (1990s to 2020), users in the “decoupled era” (beyond 2020) are expected to have “an even greater voice as they seek convenience, affordability, and security. The Decoupled Era is also shaping up to be even more reliant on technology — but with the winning technologies yet to be determined,” according to the report.

Banks will no longer be able to rely solely on the account ownership paradigm (see the map on the four ears of payment business models). The report authors assert that the former will need to build new businesses to keep customers within their service ecosystem.

Changes in the payments ecosystem have ushered in four eras of payments business models.